Location-independent entrepreneurs and remote workers increasingly seek destinations that not only offer convenient digital nomad visas but also foster a crypto-friendly environment.

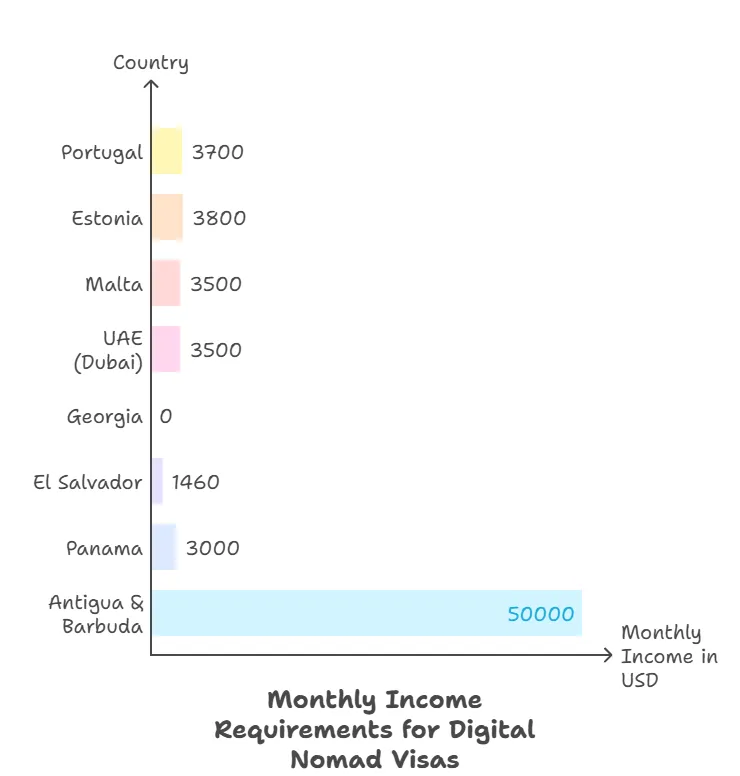

Countries around the world are adopting digital nomad visa programs, with maximum stays ranging from 6 months to 4 years (El Salvador and Mexico offer the longest). Many programs allow renewals or extensions, providing a pathway to longer residency. Additionally, identifying crypto tax free countries is crucial for cryptocurrency investors looking to minimize capital gains taxes and benefit from supportive regulations.

Digital Nomad Visa & Residency Comparison:

| Country | Visa Name | Income Requirement | Duration & Renewal | Residency/Citizenship Path |

|---|---|---|---|---|

| Portugal | D8 Digital Nomad Visa | €3,480/mo (4× min wage) (≈$3.7k) | Short-stay: 1 year; or Residence Permit: 2 years + 3-year renewal | Permanent residency & citizenship after 5 years (requires A2 language) |

| Estonia | Digital Nomad Visa | €3,504/mo (gross) (≈$3.8k) | 1 year max (non-renewable as DNV) | No direct PR; must switch to another residence (e.g. startup visa or work permit) for long-term stay |

| Malta | Nomad Residence Permit | €42,000/year (≈$45k) (≙ €3,500/mo) | 1 year; renewable twice (total up to 3 years) | No automatic PR; option to apply for other residency programs or citizenship by investment (separate) |

| UAE (Dubai) | Virtual Work Visa | $3,500/mo | 1 year; renewable annually | No permanent residency; can transition to 2-3 year investor/freelance visas or 10-year Golden Visa for investors |

| Georgia | Visa-free entry | N/A (visa-free for 365 days) | 1 year on entry stamp; can renew by exit/re-entry | Temporary residency via investment or work; PR after 5–6 years of residence (or invest $100k for PR) |

| El Salvador | Digital Nomad Visa | $1,460/mo | 2 years; extendable 2 more (4 years total) | No direct PR; option to invest (≥3 BTC or $1M) for immediate PR or citizenship |

| Panama | Short-Stay Remote Worker Visa | $3,000/mo | 9 months + one 9-month renewal | No direct PR via this visa; Friendly Nations Visa offers PR in ~2 years, citizenship after 5 years PR |

| Antigua & Barbuda | Nomad Digital Residence | $50,000/year | 2 years; non-renewable (can reapply) | No automatic PR; long-term route via Citizenship by Investment (from $100k donation) |

Crypto Taxation & Business Environment Comparison in Crypto Friendly Countries:

| Country | Crypto Tax – Individuals | Crypto Tax – Businesses | Banking & Crypto Integration | Ease of Business Setup |

|---|---|---|---|---|

| Portugal | 0% on crypto held >1 year 28% on short-term trades staking/mining treated as income (15% of earnings in simplified regime) No wealth tax. Portugal is one of the notable crypto tax friendly countries, offering significant benefits for long-term investors. | 21% corporate tax (rate on profits) if running a crypto business (normal corporate rate); but many crypto activities done personally to utilize the 0% long-term CGT | Modern EU banking; easy SEPA transfers. Banks generally allow crypto exchange use. No capital controls. Integration: Many crypto startups in Lisbon; ATMs available. | Moderate – Company registration ~1 week online. Some bureaucracy for licensing. NHR regime offers 20% flat tax on local income for 10 years Overall business-friendly, with EU market access. |

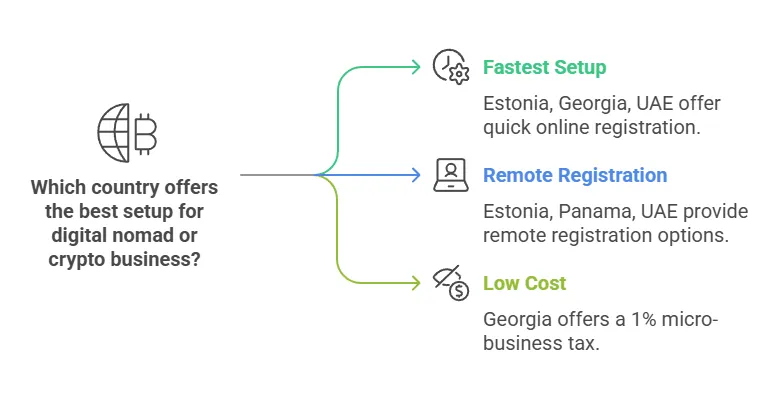

| Estonia | 20% flat tax on income/capital gains if tax resident < 183 day stay = potentially 0% (non-resident) No separate CGT; long-term holding not exempt – all gains taxed upon realization, but only if resident. Estonia’s approach to crypto taxes makes it an attractive option for digital asset investors. | 0% corporate tax on undistributed profits (retained crypto earnings tax-free) 20% on distributed profits. Crypto exchanges require license. | Highly digital banking (e-Residency for business banking). Some banks cautious with crypto transactions due to AML. Generally EU-integrated, with Wise/Revolut support. | Easy – E-Residency enables online company setup in 1-2 days. Low maintenance. Clear regulations. Some reporting needed if doing licensed crypto services, but small startups thrive with minimal overhead. |

| Malta | 0% tax on capital gains from long-term crypto investments If classified as day trading/business, progressive rates 15–35% No inheritance/wealth tax | 35% corporate tax, but effective ~5% for many international companies due to tax credits Crypto exchanges need VFA license. Personal overseas crypto income often not taxed for non-doms | International banking hub (EUR). Strong compliance – account opening can be slow. Crypto-friendly stance but banks are conservative; better to use EU fintechs for crypto. | Moderate – Incorporation ~2 weeks. Some bureaucracy, need local address. Nomad permit holders can benefit from 10% flat tax on local income Excellent professional services available. |

| UAE | 0% personal income tax (no capital gains tax at all) Crypto trades, holdings, salaries – all untaxed. No VAT on crypto trades | 9% corporate tax on profits > AED 375k (≈$102k) Many crypto businesses in Dubai/ADGM are in free zones with tax exemptions. No payroll taxes. | World-class banking (multi-currency). Need resident status to open account. Banks increasingly crypto-friendly; UAE launching licensed exchanges. No currency controls, free repatriation. | Fast – Free Zone company setup in ~1–2 weeks. Higher cost ($4k+). Most processes can be done remotely via agents. No income tax filing hassle. Excellent infrastructure for startups, but living costs high. |

| Georgia | 0% tax on crypto profits for individuals (crypto sale/exchange is tax-exempt). No capital gains tax generally. | 15% corporate tax (only on distributed profits, Estonian-style). Small business regime: 1% tax on turnover up to ~$180k Crypto mining not taxed for individuals; companies pay 15%. | Easy account opening (multi-currency accounts in GEL/USD/EUR in < 1 hour). No restrictions on crypto transfers Banks tolerant of crypto cash-outs, though informal OTC common. | Very Easy – Top-10 in Ease of Business LLC in 1-2 days; or Individual Entrepreneur 1% tax regime Minimal paperwork. E-signature available. Foreigners can own 100%. |

| El Salvador | 0% tax on crypto income and gains (Bitcoin is legal tender, treated like currency). No capital gains tax on crypto by law | 25% corporate tax if a crypto business is structured as local company (but new tech investments may get incentives). Mining/staking profits exempt for individuals | Uses USD as official currency – easy international banking. Opening accounts possible with residency. Widespread Bitcoin acceptance (Lightning network), Gov’t Chivo wallet for BTC< ->USD. Still developing international banking links, but crypto infrastructure is robust for users (ATMs, merchants). | Moderate – Company registration a few weeks. Government is pro-crypto business; launching innovation hub. Territorial tax for foreign income helps entrepreneurs. Some bureaucracy in Spanish. Citizenship by investment ($1M in BTC or bonds) for big investors |

| Panama | 0% tax on foreign-source crypto gains Crypto trades on overseas exchanges not taxed. No personal income tax unless local-sourced. | 25% corporate tax on locally-sourced income. Offshore income is tax-exempt (many Panama companies pay 0% if doing business abroad) No crypto-specific taxes or licenses yet (crypto bill pending). | Major banking center (USD currency). Banks have stringent compliance – some wary of crypto funds Many nomads use offshore accounts or fintechs for crypto. No currency controls. Easy use of USD stablecoins in economy. | Easy for offshore – Corporation in ~5 days via agent. Territorial taxation (no tax on foreign earnings) Friendly Nations Visa PR allows long-term operations with minimal presence. Some paperwork for local business but straightforward. |

| Antigua & Barbuda | 0% personal income or capital gains tax No tax on worldwide crypto gains (Antigua doesn’t tax personal income at all). | 0% tax for International Business Corporations (offshore entities). Local companies pay 25% on Antigua-sourced income (though most nomads stick to offshore status). Digital Assets Business Act provides licensing for exchanges/wallets | Small banking sector; USD and XCD used. Bank accounts possible for residents; due diligence required. Very free flow of funds – no exchange controls. Gov’t accepts crypto for fees (even citizenship) Limited local crypto exchange options; usage mostly peer-to-peer. | Easy for offshore – IBC or trust formation via service providers in days. Minimal reporting. Onshore business setup is straightforward but requires local trust if employing locals. Very pro-investor climate; quick governmental support due to small size. |

Portugal

Digital Nomad Visa & Residency: Portugal’s D8 “Digital Nomad” Visa offers two tracks: a temporary stay visa (up to 1 year) or a residence permit. The residency route begins with a 4-month entry visa, after which you can obtain a 2-year residence permit (renewable for 3 more years). Applicants must show remote work income at least four times the Portuguese minimum wage (≈€3,480 per month, ~USD $3,700). This visa accommodates both employees of foreign companies and freelancers. After 5 years of residency, holders may apply for permanent residence or even citizenship, subject to passing a basic Portuguese language test. Family reunification is allowed for spouses and dependents under the long-stay visa.

Crypto Taxation & Regulations: Portugal has long been regarded as a crypto-friendly jurisdiction. Cryptocurrency gains are tax-free for individuals as long as the assets are held for more than one year. Beginning in 2023, short-term crypto profits (<1 year) are subject to a flat 28% capital gains tax. Occasional traders and long-term investors still pay 0% on qualifying crypto gains, whereas professional crypto trading or business activities can be taxed as income. Portugal does not treat crypto as legal tender, but the regulatory stance is accommodating; the country is aligning with EU’s upcoming MiCA regulations while maintaining incentives (Portugal did not tax most crypto holdings prior to 2023). Many crypto startups and blockchain companies operate in Lisbon’s growing tech scene under clear regulatory guidelines.

Banking & Financial Ecosystem: Portugal’s banking system is modern and internationally integrated (part of SEPA). As a resident, opening a local bank account is straightforward with proper ID and proof of address. Major banks in Portugal offer online banking in English. Integration with crypto exchanges is generally smooth – there are no blanket bans on using exchanges like Binance or Coinbase, and banks allow transfers to these platforms. Under the Non-Habitual Resident (NHR) program, foreign-sourced income (potentially including certain crypto income) can be tax-advantaged, which attracts crypto investors. While Portugal doesn’t yet have special crypto-business licenses, it permits crypto firms under existing laws and offers venture capital funding and incubators for blockchain ventures in hubs like Lisbon and Porto.

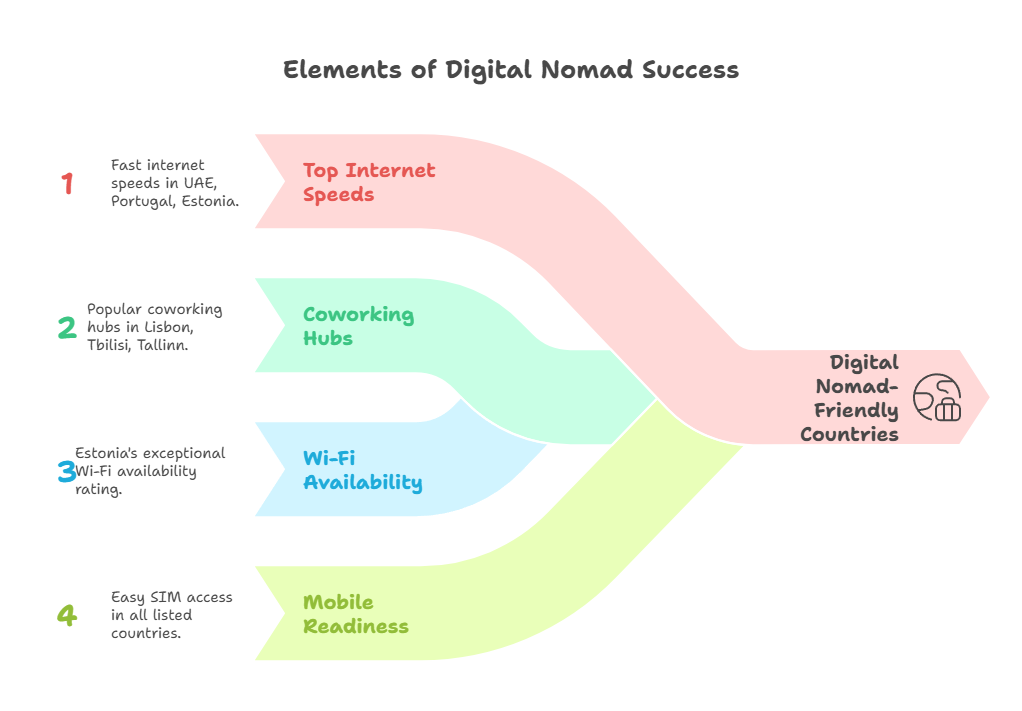

Internet & Infrastructure: Portugal boasts reliable infrastructure. High-speed broadband is widely available – average fixed-line download speeds exceed 150 Mbps in urban areas (Portugal ranked ~20th globally for fixed internet speed in early 2025). Mobile 4G/5G coverage is extensive, making it easy for nomads to work from coastal towns or the remote island of Madeira (which markets itself as a “Digital Nomad Village”). You’ll find numerous coworking spaces and tech hubs, especially in Lisbon, Porto, and the Algarve region. Public transit is efficient, and major cities have plenty of cafes with Wi-Fi, supporting a comfortable remote work lifestyle.

Ease of Setting Up Remote Business: Portugal is reasonably business-friendly. Forming a company (e.g. an LDA, similar to an LLC) can be done online via the “Empresa Online” portal in as little as 1-2 days, though many foreigners use lawyers or service providers. Bureaucracy is moderate – Portugal ranked about 39th in the World Bank’s Ease of Doing Business index pre-2020. The timeline for business registration is a couple of weeks on average. On the upside, Portugal’s “Tech Visa” and startup incubators support foreign entrepreneurs. There isn’t an e-residency program, but the D8 visa itself grants the legal ability to conduct business activities. Remote business owners often leverage Portugal’s tax treaties and EU market access. Overall, setting up a base in Portugal is straightforward, with a clear path to EU-wide operations and eventual citizenship – a combination that’s highly attractive for crypto entrepreneurs and digital nomads alike.

Estonia

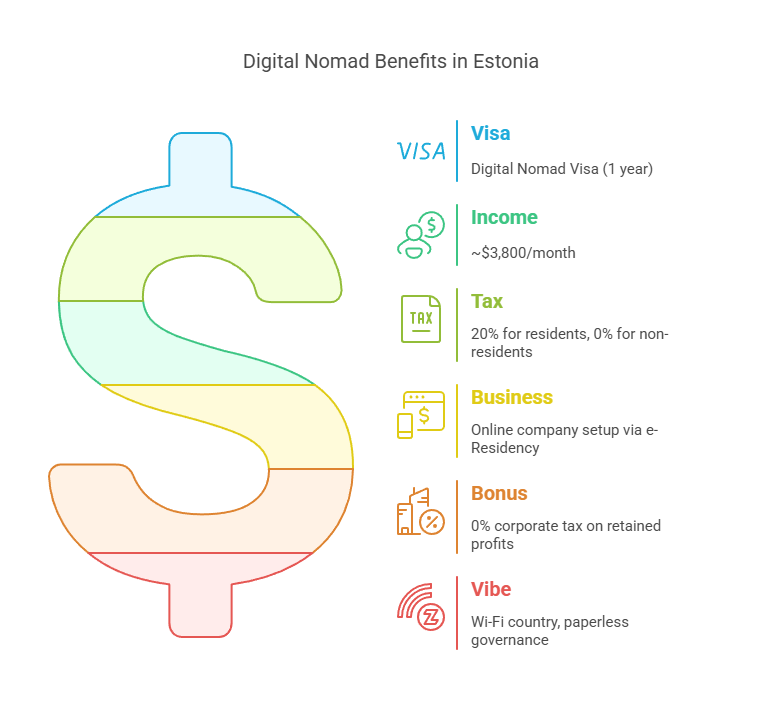

Digital Nomad Visa & Residency: Estonia pioneered e-Governance with its e-Residency program, and in 2020 it introduced a Digital Nomad Visa (DNV) for non-EU nationals. The Estonian DNV allows remote workers to live in Estonia for up to 1 year while working for an overseas employer or as a freelancer. Applicants must demonstrate a gross monthly income of around €3,500 (~USD $3,800), which equates to an annual income of €42,000. The visa fee is low (about $100). While the nomad visa itself is temporary and not directly a path to permanent residency, it gives a taste of life in Estonia. Those wishing to stay longer can explore Estonia’s startup visa or employment visas. Notably, if you spend over 183 days in Estonia, you may become tax resident – the rules can be complex. (Some nomads limit their stay to < 6 months or maintain home-country tax ties to avoid immediate Estonian taxation.) Still, Estonia offers an appealing gateway to the Schengen Area (visa includes Schengen travel up to 90 days). Estonia’s tech hubs, often referred to as a ‘crypto valley’, provide a supportive environment for blockchain startups and tech entrepreneurs.

Crypto Taxation & Regulations: Estonia is a digital society with clear crypto regulations. For individuals considered Estonian tax residents, crypto is taxed at the flat 20% personal income tax rate, similar to stocks or any investment income. However, long-term holders benefit from Estonia’s territorial-like system: if you are not tax resident (e.g., stay < 183 days or maintain non-resident status), you owe no local tax on foreign-source crypto income. Estonia’s hallmark is zero corporate tax on retained earnings – companies (including crypto startups) only pay the 20% tax on distributed profits. This encourages reinvestment. Crypto-specific laws: Estonia was one of the first EU countries to license crypto exchanges and wallet providers. After a boom in licenses, the government tightened requirements in 2022 to comply with AML norms. Legitimate crypto businesses still thrive, but must meet higher standards. In summary, Estonia’s tax regime is simple and transparent – no capital gains tax separately, just 20% on gains or business income, and potentially tax-free for nomads who don’t establish tax residency. The nation’s “digital first” approach extends to crypto, with government-issued guidance and an overall positive stance on blockchain tech.

Banking & Financial Ecosystem: Estonian banks and fintechs are highly digital. As an e-resident or visa holder, you can open online bank accounts with banks like LHV or fintech alternatives (Wise, Revolut) that cater to remote entrepreneurs. Estonia is part of SEPA, so EUR transactions are seamless. The banking sector is conservative due to strict AML rules – crypto-related transactions might prompt compliance checks, but crypto investors aren’t outlawed. Many nomads use crypto-friendly services or retain accounts in their home country for crypto trading. Integration with crypto: Estonia has ATMs and merchants accepting crypto in Tallinn. The government itself experimented with crypto (e-Residency program considered issuing “estcoin”). While banks may not directly offer crypto services, they allow linkage to regulated exchanges. Overall, Estonia’s financial ecosystem is tuned for tech: expect e-signatures, digital ID, and paperless processes for most banking and business needs.

Internet & Infrastructure: Estonia consistently ranks among the best in the world for internet connectivity. It is often nicknamed the “Wi-Fi country” – free Wi-Fi is abundant in cities and even forests. Broadband speeds are excellent (Tallinn’s average download speed is well over 100 Mbps, and Estonia scored a perfect 10/10 for internet in one remote work index). The country’s digital infrastructure (from online public services to 4G mobile coverage) is top-notch. Coworking spaces and startup incubators like Lift99 and Tehnopol dot Tallinn and Tartu, providing plenty of options for remote work. Even small towns have modern coworking hubs thanks to Estonia’s tech outreach programs. Besides tech, Estonia offers a high standard of living (clean air, low pollution, high safety scores), making it comfortable for expats. Winters are cold and daylight short, but many nomads enjoy the cultural experience or hop to warmer climates in deep winter.

Ease of Setting Up Remote Business: Estonia is famous for making business easy. Through e-Residency, foreign entrepreneurs can register an EU-based company entirely online and manage it remotely with digital signatures. Incorporation takes only a day or two once documents are in order. The bureaucracy is minimal – Estonia ranked 18th globally in Ease of Doing Business 2020 and 7th in economic freedom in Europe. You can expect low incorporation costs (~€190 state fee) and no requirement for local directors (though a local legal address is needed, easily provided by service companies). Tax filing is online and straightforward; if you’re a one-person company and pay yourself modestly, you might even avoid most taxes (only paying the 20% when you distribute dividends). Note: if you live in Estonia long-term and draw a salary, you’ll pay 20% income tax and social taxes – but for purely remote businesses run from abroad, Estonia’s regime is extremely attractive. There is no formal e-residency “visa”, but pairing the e-Residency (for business) with the Digital Nomad Visa (for living in Estonia short-term) gives you the best of both worlds. In short, Estonia offers perhaps the smoothest online business setup on the planet, ideal for a crypto entrepreneur who wants an EU-based company without red tape.

Malta

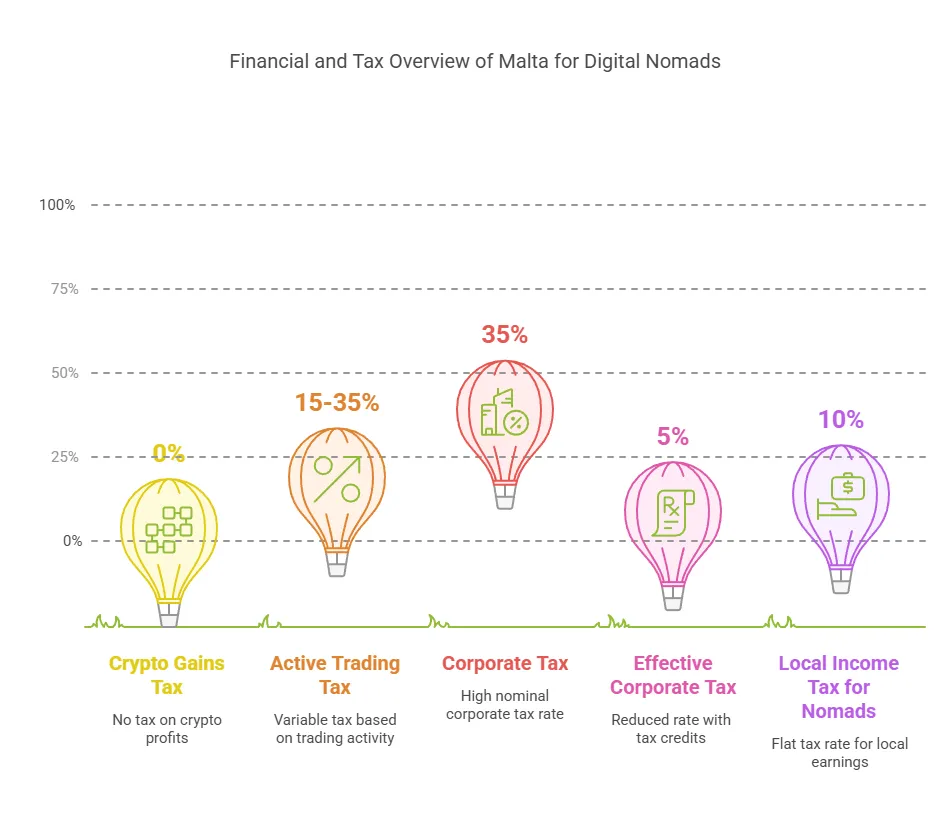

Digital Nomad Visa & Residency: Malta’s Nomad Residence Permit is a one-year visa for non-EU remote workers, with the possibility to renew up to a total of 3 years. To qualify, applicants need a minimum gross income of €42,000 per year (≈USD $45k), which works out to about €3,500 per month (this was increased from €2,700/month as of 2024). You must be employed by a company outside Malta or be a freelancer/consultant with foreign clients. The Nomad Permit lets you reside in Malta with your family (spouse and minor children) as long as you meet additional income requirements. While on this visa, you retain tax residency in your home country initially, but if you stay beyond 183 days, Malta offers a special flat 15% tax on remitted income or even a 10% flat tax for Nomad visa holders on local income (we discuss taxes below). The permit does not directly lead to permanent residency or citizenship, but after several years in Malta (typically 5) on other visa types one could pursue long-term residence. Many digital nomads eventually transition to Malta’s Global Residence Program or Permanent Residency by Investment if they decide to settle long-term. Malta is also considered one of the ‘crypto tax friendly countries’, making it an attractive option for cryptocurrency investors.

Crypto Taxation & Regulations: Malta is famously known as the “Blockchain Island.” For individual residents, capital gains from crypto investments are tax-free. In Malta, cryptocurrency is treated much like stock or foreign currency for casual investors – long-term holdings and one-off sales are not taxed as capital gains. However, if one is actively trading, mining, or staking crypto as a business, such activity is viewed as business income and **taxed at the progressive income tax rates (15%–35%). (Social security contributions would also apply in that case.) For corporate entities, Malta’s standard 35% corporate tax applies to crypto trading profits, but foreign investors often utilize Malta’s full-imputation system which can reduce the effective tax to 5% on distributed profits. Malta has a robust regulatory framework: the Virtual Financial Assets Act and related laws establish licensing for crypto exchanges, ICOs, and other services, ensuring compliance with EU standards while fostering innovation. In practice, this attracted many crypto companies (exchange Binance had an office here, for example). In summary, crypto held as a personal investment is not taxed in Malta, making it very attractive to crypto investors, whereas crypto business activities are taxed similarly to any commercial activity. The government remains very supportive of blockchain – even exploring government blockchain projects – reinforcing Malta’s image as a crypto-friendly hub.

Banking & Financial Ecosystem: Malta’s financial system is advanced (part of the EU and Eurozone) but known for rigorous compliance. Opening a personal bank account in Malta is doable for residents – you’ll need a residence card, proof of address, and source-of-funds documents. Some nomads report that using international digital banks is faster initially. For business banking, Malta has historically been a bit challenging for new crypto businesses due to de-risking by some banks, but it’s improving as the regulatory environment matures. Integration with international banking is seamless (SEPA transfers in EUR, SWIFT globally). Crypto-fiat integration: while local Maltese banks might not directly deal with crypto, many European payment processors in Malta serve crypto firms. Also, banks do not tax incoming foreign funds for non-domiciled residents – meaning if you keep your crypto earnings offshore and just bring in what you need, it can remain untaxed. Malta’s stance on crypto as a financial instrument is officially welcoming: the MFSA (regulator) provides licenses to crypto operators, and Malta was one of the first countries to offer a regulatory sandbox for crypto. As a nomad, you can comfortably use global exchanges; Malta does not restrict access. Additionally, several crypto ATMs and service providers operate on the island. All said, banking in Malta is stable and internationally connected, and while paperwork can be slow, once set up, you have a Euro account in an EU financial center.

Internet & Infrastructure: Malta has excellent internet coverage. Being a small island nation, it invested heavily in connectivity – 96% of households have access to high-speed broadband (at least 100 Mbps). Fiber internet and 5G mobile are available in the dense urban areas of Malta and Gozo. Nomads will find coworking spaces in Valletta, Sliema, and St. Julian’s (which are hotspots for expats). English is an official language, so getting services or setting up utilities (like home broadband or a mobile SIM) is straightforward. The island offers a sunny Mediterranean climate and a vibrant expat community. On the flip side, traffic can be congested and Malta’s small size means limited travel distances – but also that nothing is very far away. Power and water infrastructure is reliable. For work, you can expect a variety of cafés with Wi-Fi, plus coworking venues like Mosaic, Regus, and others that cater to remote professionals. In summary, Malta’s infrastructure is fully up to EU standards – you’ll enjoy modern amenities in a historic island setting.

Ease of Setting Up Remote Business: Setting up a company in Malta involves a bit more bureaucracy than some other locales, but it’s quite manageable. Company registration (through the Malta Business Registry) usually takes 1-2 weeks and requires notarized documents and a minimum share capital (€1,165 for a private LLC, of which ~€250 must be paid in). Many nomads work through a Maltese “personal business” setup: either registering as self-employed or incorporating a limited company if needed for international contracting. While Malta doesn’t have an e-residency program, you can handle a lot remotely via licensed corporate service providers. Online incorporation support: Malta has improved online services – tax filings, social security, etc., can all be done through electronic portals once you’re set up. One big draw for Malta is favorable tax schemes for foreign residents (e.g. the Resident Non-Domiciled regime allows foreign income remitted to Malta to be taxed at a flat €15,000 annually in some cases, and the Nomad permit itself offers a 10% flat tax on local earnings). This can simplify tax planning for a remote business. On the downside, accounting and compliance can be paperwork-heavy – you’ll likely need an accountant for annual filings. Still, Malta’s strategic location (EU member, euro currency, strong legal system) plus its network of double taxation treaties make it a solid base for a remote business targeting EU or Middle Eastern markets. In essence, if you don’t mind a bit of admin and perhaps hiring a local service provider at first, Malta offers a stable, low-tax environment for running a crypto-friendly business.

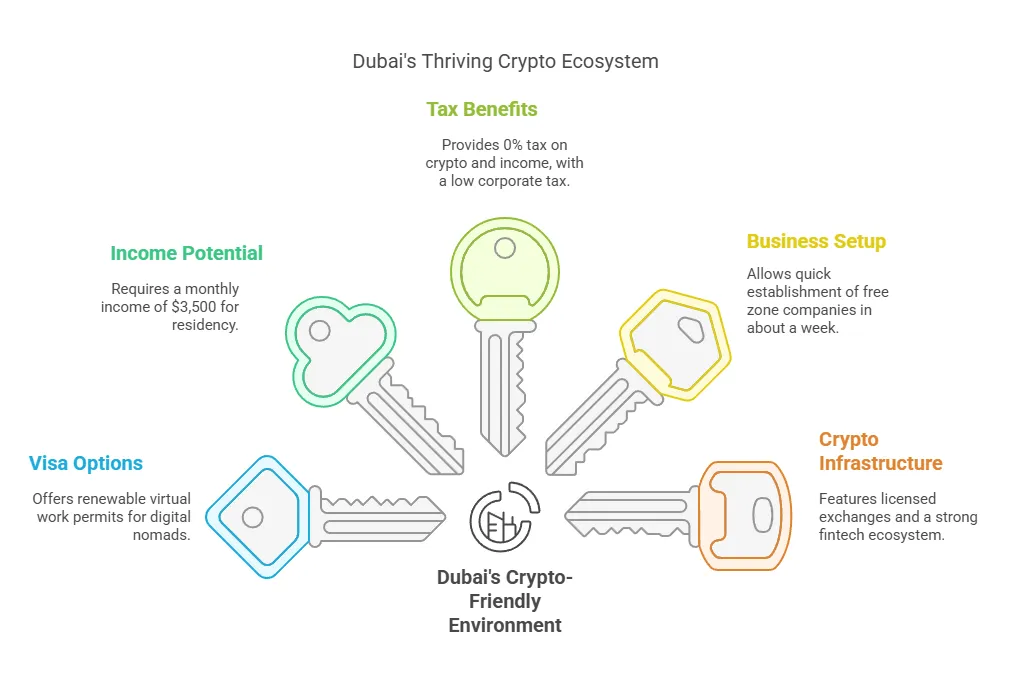

United Arab Emirates (UAE) with Zero Capital Gains Tax

Digital Nomad Visa & Residency: The UAE (particularly Dubai) launched a Virtual Work Residence Permit in 2021 to attract remote workers. This 1-year digital nomad visa requires proof of monthly income of at least $3,500 (≈ AED 12,800), a remote employment contract (or proof of business ownership abroad), and health insurance. The visa is renewable annually, as long as you continue to meet the criteria. With this visa, you get a UAE resident ID, allowing you to rent accommodation and access services in Dubai. Beyond the remote work visa, expats can also obtain residence through other means: company formation (setting up a business in a UAE free zone grants a 2-3 year investor visa), property purchase (invest ~AED 750,000 in property for a 2-year visa), or the Golden Visa program (10-year residency for significant investors or talent). However, those latter routes typically require larger investments. The Dubai Remote Work Visa does not directly lead to permanent residency (the UAE doesn’t offer “permanent” residence – visas are long-term but ultimately renewable permits). Citizenship is extremely rare for foreigners. That said, the UAE has been introducing more pathways for long-term stay; a digital nomad could potentially transition to a 5-year Green Visa (for freelancers/self-employed if earning $4,000/month) or other longer visas if they become eligible. In summary, the UAE offers flexible residency pathways for remote professionals, with Dubai’s 1-year visa being the most accessible initial option. Additionally, the UAE is one of the prominent crypto tax free countries, making it an attractive destination for cryptocurrency investors.

Crypto Taxation & Regulations: The UAE is a tax haven for individuals – it levies no personal income tax or capital gains tax on residents (this includes crypto gains). Crypto traders and investors pay 0% tax on their profits in the UAE. (There is a small caveat: from 2023, the UAE introduced a federal corporate tax of 9% on business profits over AED 375,000 (~USD $102k), but this typically does not affect individuals trading on their own behalf, and many free-zone companies are exempt.) In 2024, the government even exempted crypto transactions from VAT (5% value-added tax) to further encourage the industry. Regulatory stance: The UAE is extremely pro-crypto, viewing it as a key sector for growth. It established regulatory bodies like VARA (Virtual Assets Regulatory Authority) in Dubai, and ADGM (Abu Dhabi Global Market) fintech regime, which issue licenses to crypto exchanges, OTC brokers, and even crypto mining operations. Major crypto companies (Binance, Kraken, Crypto.com) have received licenses or set up regional HQs in the UAE. Legal use of crypto: While the UAE does not consider crypto legal tender (Dirhams remain the only official currency), it allows crypto trading and even launched a central bank digital currency trial. In summary, a crypto investor in the UAE enjoys no taxes and a supportive regulatory framework – a combination that makes Dubai a “crypto paradise” for traders. The only considerations are to ensure you remain a tax resident of the UAE (which usually means spending >183 days in country or having your center of life there) and that you use licensed exchanges for compliance. Businesses dealing in crypto may face the 9% corporate tax if they exceed profit thresholds, but free zones and various incentives can mitigate this. All told, the UAE’s approach is clear and welcoming: it wants to be a global hub for blockchain and digital assets, and its tax/regulatory policies reflect that.

Banking & Financial Ecosystem: The UAE is a global banking center with branches of international banks (HSBC, Citi, Standard Chartered) and strong local banks (Emirates NBD, ADCB, etc.). As a resident, you can open personal bank accounts – for the nomad visa, once you have your Emirates ID, you’re eligible. Banking in the UAE is modern (mobile apps, online banking widely used) but expects high compliance (you’ll need to show proof of income and often a salary letter or proof of local address). Integration with crypto has improved drastically: several UAE banks now allow customers to link accounts to crypto platforms or have partnerships with exchanges. There are also crypto-friendly financial services in the Dubai International Financial Centre (DIFC). One can easily find OTC desks in Dubai to cash out crypto, or use global exchanges that operate in the region. Payment habits: The UAE is very digital – contactless payments, mobile wallets, and even some crypto payment gateways (e.g., an increasing number of real estate developers and luxury car dealers accept Bitcoin or USDT in Dubai). The government itself launched the Dubai Blockchain Strategy, aiming to put many government transactions on blockchain. For a remote entrepreneur, business banking can be obtained by setting up in a free zone; note that bank minimum balance requirements can be high (often ~$10,000). But on the personal side, once you have an income or savings, maintaining a UAE bank account is straightforward. Financial freedom: The UAE has no currency controls, so you can move money freely (great for crypto liquidity events). Overall, you’ll find the UAE banking ecosystem sophisticated and increasingly crypto-aware, provided you maintain transparency and meet the financial requirements (the UAE is keen to shake off any “tax haven” criticisms by enforcing proper KYC/AML).

Internet & Infrastructure: The UAE offers world-class infrastructure. Internet speeds are among the fastest globally – Dubai and Abu Dhabi have prevalent fiber-to-home connections, and the UAE ranks near the top for mobile internet speed (its 5G rollout is one of the most advanced). Nomads can expect average broadband speeds well above 150 Mbps in cities, and mobile download speeds often exceeding 250 Mbps on 5G. Getting connected is easy: local SIM cards (Etisalat or du) are available with passport/visa, and offer generous data packages. Public Wi-Fi is common in malls, cafes, and co-working centers. Speaking of which, the coworking scene is booming: you’ll find everything from global chains like WeWork to local spaces (Astrolabs, Nook, etc.) that cater to startups and freelancers. Power supply is extremely stable (virtually no outages). Coworking costs can be higher than in some countries, but they come with amenities and networking events. Infrastructure goes beyond internet: public transport in Dubai (metro, trams) is modern and affordable, ride-hailing is ubiquitous, and roads are excellent. The only challenge might be the hot climate in summer (peak heat can keep you indoors), but indoor spaces are well air-conditioned. Overall, the UAE offers a comfortable, high-tech environment for work – you can just as easily trade crypto from a beach club in Dubai (with Wi-Fi) as from a dedicated fintech hub. The combination of a cutting-edge skyline, reliable utilities, and top-tier connectivity makes the UAE extremely appealing to digital professionals.

Ease of Setting Up Remote Business: The UAE is known for quickly getting business running – if you’re willing to navigate its system or hire a service agent. There’s a bit of bureaucracy upfront (and fees) to establish a company, but the process is efficient by regional standards. Many digital nomads opt for a free zone company (there are 40+ free trade zones across the Emirates, each with different focuses and costs). For example, Dubai’s DMCC or IFZA, or Ras Al Khaimah’s RAKEZ, allow 100% foreign ownership and offer packages to form a company in 1-2 weeks. Fees can range from ~$4,000 to $7,000 for a simple consultancy license, which then provides a residence visa for 2-3 years. The entire application can be done online or via email with the free zone authority – you typically submit passport scans, a business plan, and choose a company name, etc. Physical presence is only required at the end for signing and visa stamping. The UAE doesn’t have an e-residency program, but it increasingly digitalizes government services (Dubai’s aim is to be paperless). Bureaucracy: Expect to have to renew licenses annually and maintain a local address (usually provided by the free zone). Reporting requirements are relatively light – no income tax filings for most, though from 2023 some companies will file simple corporate tax returns (if applicable). Support for remote operations: Many free zones now allow fully remote incorporation and even e-banking setups. Additionally, the UAE has launched freelancer permits (like GoFreelance in Dubai) for individuals which simplifies being a one-person business. The timeline to be operational is short – you could conceivably land in Dubai and have a legal entity and bank account within a month. Government initiatives like Dubai’s Future District and Abu Dhabi Hub71 offer support and networking for startups, including crypto/blockchain firms. One thing to note: costs of doing business (office rent, visa fees) are higher than in, say, Georgia or Estonia, so budget accordingly. But in return, you get a prestigious business base with zero tax and access to the broader Middle East market. Overall, the UAE makes it very easy to “open shop” quickly, and its policies are explicitly designed to attract entrepreneurs and investors – perfect for a crypto startup or consulting firm that wants a no-tax base of operations.

Georgia

Digital Nomad Visa & Residency: Georgia is a hidden gem for nomads, notable for its liberal entry policy. Citizens of 90+ countries (including the US, Canada, EU, UK, etc.) can stay in Georgia visa-free for up to one year continuously. This means many digital nomads don’t even need a formal visa to base themselves in Tbilisi or Batumi – a passport stamp on arrival grants 365 days of legal stay. If you wish to stay longer, you can do a quick border run (e.g., a day trip to Turkey or Armenia) and re-enter for another year. Georgia briefly ran a “Remotely from Georgia” program during 2020 for those from countries without visa-free access, but as of 2025 the standard regime is generous enough. Residency pathways: If you intend to settle more permanently, Georgia offers temporary residence permits if you work for a Georgian entity or establish a business, and permanent residency if you invest >$100,000 in real estate or have lived in Georgia for 6 years. However, many nomads simply enjoy the renewable 1-year visa-free status. There’s also an Option for Residency via Entrepreneurship: registering as an individual entrepreneur (with verification of sufficient income) can sometimes help in obtaining a short-term residence permit. Citizenship is obtainable after 10 years of residence (or immediately at the President’s discretion for notable investors), but most expats focus on the ease of entry and living rather than citizenship. The key point: Georgia imposes virtually no bureaucratic hurdles for remote workers to live for an extended period, making it one of the most accessible “nomad visas” in practice (just without the label). Additionally, Georgia is recognized as one of the crypto tax free countries, attracting many cryptocurrency investors due to its favorable tax policies.

Crypto Taxation & Regulations: Georgia is exceedingly crypto-friendly in terms of taxes. Individuals in Georgia are exempt from income tax on profits from the sale of cryptocurrency. In June 2019, the Georgian Finance Minister signed a bill clarifying that crypto-to-fiat or crypto-to-crypto trades by individuals are not subject to tax, and such transactions are also VAT-exempt. In short, Georgia has 0% capital gains tax on crypto for individuals, and no VAT on exchange of crypto to local currency (Lari). Businesses involved in crypto do have to pay taxes on local operations – the corporate tax is 15%, but Georgia’s tax system has a twist: corporate profits are only taxed when distributed (similar to Estonia). Additionally, Georgia offers special zones and regimes: IT companies can get a Virtual Zone status for 0% tax on export income (often used by blockchain developers), and small businesses (under ~$155k annual turnover) pay just 1% tax on gross revenue. Regulation: Georgia has no strict crypto-specific regulations; the industry operates in a legal grey but permitted area. Crypto mining boomed due to cheap electricity – at one point Georgia was among the top Bitcoin mining countries. The government has been positive toward blockchain (they were one of the first to put land titles on a blockchain). Currently, no license is required to trade or hold crypto, and local crypto exchanges exist but are lightly regulated. The National Bank of Georgia has warned about risks but not imposed bans. This laissez-faire approach, coupled with the tax neutrality, makes Georgia extremely attractive for crypto traders and startups. A crypto investor can freely buy/sell on global exchanges without worrying about local taxes, and even converting crypto to fiat in Georgia incurs no tax – effectively making it a crypto tax haven. (Do note that if you earn crypto as salary from a Georgian company, it might be subject to income tax, but most nomads earn from abroad.) Overall, Georgia’s message is: bring your crypto activities here, you won’t be taxed – and this policy has indeed drawn many crypto nomads to Tbilisi.

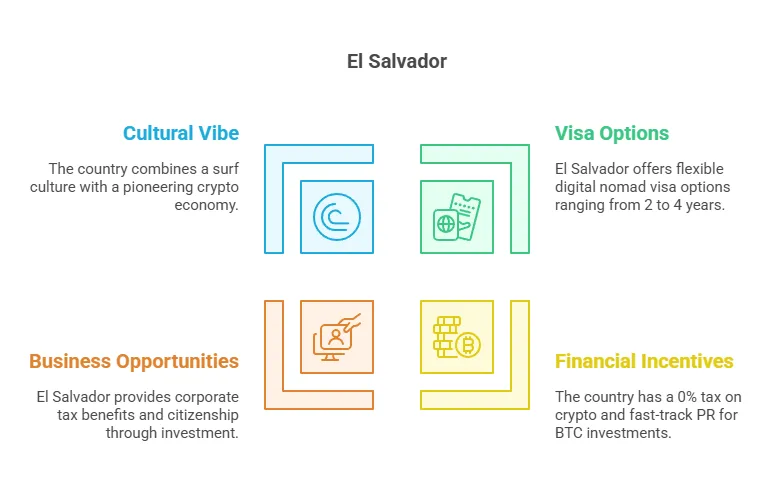

El Salvador Among Crypto Tax Free Countries

Digital Nomad Visa & Residency: El Salvador made headlines as the first country to adopt Bitcoin as legal tender, and it’s angling to attract crypto-minded nomads. In 2023, El Salvador introduced a Digital Nomad Visa that allows qualifying remote workers to live in the country for up to 2 years, renewable for an additional 2 years. That means you can stay up to 4 years total on this visa, one of the longest durations globally. To be eligible, you must show a monthly income of $1,460 or more (approximately $17,520/year) from remote work. The visa application fee is relatively steep ($2,820, plus $450 for a renewal), reflecting the country’s push for serious applicants. Applicants also need proof of health insurance and a clean background check. The visa permits multiple entries, so you can travel in and out of El Salvador freely. While on the nomad visa, you are not obliged to pay Salvadoran income taxes (the law explicitly exempts foreign income for visa holders). After 4 years, there isn’t an automatic permanent residency, but El Salvador offers other routes: notably, investors who invest 3 BTC (~$100k+) in the country are eligible for immediate permanent residency, and a new law in 2023 allows fast-track citizenship by investment of $1 million in Bitcoin or government bonds. Additionally, if you end up living in El Salvador long-term, naturalization is possible after 5 years of regular residency (the nomad visa time may count if you transition to a resident status). In short, El Salvador’s nomad visa is easy to obtain for those with modest remote incomes and aligns with the country’s crypto-friendly ethos. It provides a multi-year Caribbean lifestyle (volcanoes and surf included) and can be a stepping stone to residency by investment or citizenship if you fall in love with the country. El Salvador is also one of the notable crypto tax free countries, making it an attractive option for cryptocurrency investors.

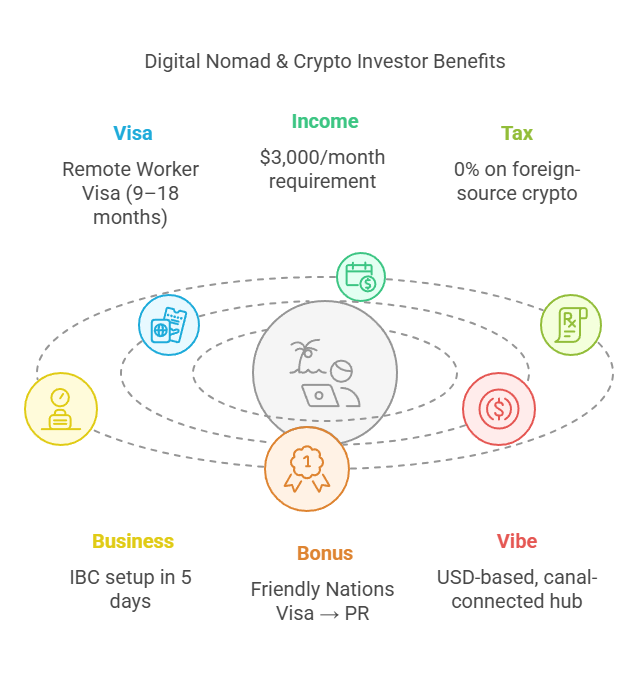

Panama

Digital Nomad Visa & Residency: Panama offers a couple of attractive options for remote workers. First, the Short-Stay Remote Worker Visa (launched in 2021) lets you reside in Panama for 9 months, with a one-time extension for another 9 months (total 18 months). To qualify, you must earn at least $3,000 per month (or $36,000/year) from a foreign employer or your own business abroad, and have health insurance. The application is relatively straightforward and the fee is $250. This visa explicitly exempts remote workers from local income tax on their foreign-sourced income during their stay. After 18 months, you’re expected to switch to another visa if you wish to stay longer. This is where Panama’s famous Friendly Nations Visa (FNV) comes in. The FNV is a residency (not specifically for nomads) that allows nationals of 50+ “friendly” countries (US, Canada, EU, UK, Australia, etc.) to obtain permanent residence in Panama by making a modest investment or tying to Panama. Historically, one could get it by simply setting up a local company and depositing $5k in a bank; as of 2022 changes, now an investment – e.g., buying $200,000 in real estate – or obtaining a local employment offer is required. The Friendly Nations residency grants an immediate 2-year temporary residency, then permanent residency thereafter, with the option of applying for citizenship after 5 years of permanent residency. For digital entrepreneurs, Panama’s residency is appealing because of its territorial tax system (only local income taxed). Many nomads first use the Remote Worker Visa to test Panama, then transition to Friendly Nations if they decide to base there long-term. In any case, Panama does not impose onerous stay requirements – you can keep your residency active with a short visit every two years or so. Additionally, Panama is one of the notable crypto tax free countries, making it highly attractive for cryptocurrency investors. In summary, Panama’s immigration policies are welcoming: short-term nomad visa for quick entry and an accessible permanent residency for those who want to make Panama a long-term base.

Crypto Taxation & Regulations: Panama is often cited as a crypto tax haven, thanks to its territorial tax regime. Income or gains derived from assets outside Panama are not subject to Panamanian tax. This means if you’re trading on international crypto exchanges, or earning from a foreign crypto investment, Panama won’t tax those profits. Even if you bring the money into Panama, as long as the source was abroad, it remains untaxed. For crypto specifically, Panama currently has no specific taxes – cryptocurrency is not explicitly mentioned in tax law, meaning it falls under general principles. As long as your crypto transactions occur on foreign platforms (which they typically do), they are treated as foreign-sourced and tax-free in Panama. If you run a crypto business within Panama (say a local exchange serving Panamanians), that local income would be taxable, but general trading or investing is not. In April 2022, Panama’s legislature actually passed a bill to regulate crypto and even allow citizens to pay taxes in crypto, but the president vetoed parts of it; as of 2025, a revised crypto bill is still pending. Regardless, owning and using crypto is legal and unregulated – Panamanians freely use Binance, etc., and the government has a hands-off approach. Regulation status: Because Panama hasn’t passed a comprehensive crypto law yet, there’s a regulatory vacuum – which isn’t bad for investors (no extra compliance to worry about). It does mean there’s no official investor protection scheme for crypto, but most see Panama’s approach as laissez-faire. The financial regulators have signaled interest in compliance standards (esp. to avoid Panama being a black hole for illicit funds), so if you start a crypto company, you might choose to voluntarily follow global KYC/AML best practices. But as an individual, you won’t face restrictions. Also notable: the Panama Canal and financial sector’s international nature make the government generally aligned with global norms, so if international standards evolve (like the OECD’s crypto asset reporting rules), Panama might adapt. However, given the territorial tax shield, even information reported might not trigger local taxes. Bottom line: a crypto investor in Panama can cash out and enjoy gains without local taxes, and the government so far is supportive or at least not obstructive – Panama wants to remain competitive with neighbors like El Salvador (which went the legal tender route) by being the comfortable, low-tax option.

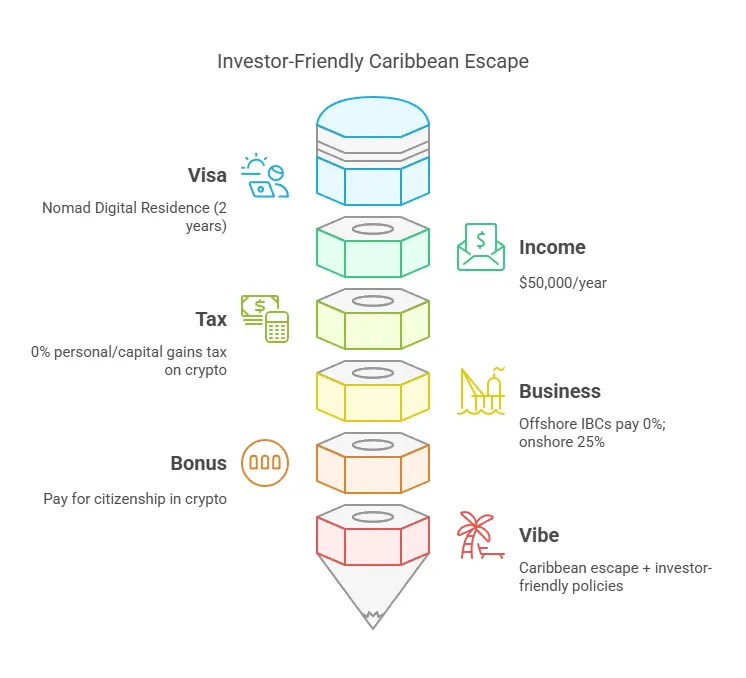

Antigua & Barbuda

Digital Nomad Visa & Residency: Antigua and Barbuda, a twin-island Caribbean nation, offers the Nomad Digital Residence (NDR) Visa. This program grants approved remote workers and their families the right to live in Antigua for up to 2 years. The eligibility requirements include a minimum annual income of $50,000 USD (for single applicants) and proof of employment or business outside of Antigua. You also need to have health insurance coverage for the duration of your stay. The application can be done online and carries a fee (around $1,500 for an individual, $2,000 for a couple, and $3,000 for a family). Once approved, you have to establish residence in Antigua within 6 months of approval. The NDR visa is quite straightforward: it’s essentially a 2-year residence permit. If you wish to stay longer after it expires, you would likely need to reapply or transition to another residency route. Antigua does not have a direct path from the NDR to citizenship, but it famously offers Citizenship by Investment (CBI) if you decide to put down roots (e.g., a $200,000 contribution or $300,000 real estate purchase can get you a passport). Permanent residency in the traditional sense isn’t common without CBI or marriage, since most expats use either the nomad visa or the CBI route. However, two years in Antigua as a nomad can be an enticing taste of Caribbean life. Notably, the NDR visa doesn’t impose local tax and doesn’t require you to work for an Antiguan entity. Antigua is also one of the crypto tax free countries, making it an attractive option for cryptocurrency investors. In summary, Antigua’s digital nomad visa is an easy, if high-income-requirement, option for a couple of years in a tropical, low-tax paradise, with the option to pivot to more permanent status via investment if desired.

Crypto Taxation & Regulations: Antigua & Barbuda is a classic no personal income tax jurisdiction. There are no capital gains taxes, no personal income taxes, and no inheritance taxes levied in Antigua. This applies to crypto as well – any gains or income you make from cryptocurrency are not taxed by the local government (as long as you are considered a tax resident in Antigua, which if you’re spending time there on the NDR visa, you likely would be, although Antigua’s concept of tax residency is generous since they don’t tax personal income anyway). In essence, Antigua is a tax-efficient haven for crypto holders. On the regulatory front, Antigua has taken steps to embrace digital assets. It implemented the Digital Assets Business Act in 2020, which provides a framework for licensing crypto businesses like exchanges, custodians, and payment service providers. The act sets standards for those businesses (including KYC/AML) but also signals the nation’s openness to crypto innovation. Additionally, Antigua’s government has been crypto-forward in other ways: they’ve discussed adopting crypto for public payments and even accept cryptocurrency as payment for their Citizenship by Investment program (you can literally pay in Bitcoin or Ethereum to make the required investment for citizenship). This shows an unusually progressive stance at a national level. For everyday use, crypto is not mainstream among the population, but the expat community and some merchants do engage – you might find a resort or two accepting Bitcoin. The Eastern Caribbean Central Bank (which issues the common currency XCD) has its own regional digital currency pilot (DCash), and Antigua participated, showing interest in fintech. Practically speaking, a crypto investor in Antigua can trade and realize gains without any local tax or much scrutiny; if they set up a crypto business, they would follow the Digital Assets Act for compliance, but also benefit from 0% corporate tax for offshore companies (Antigua companies pay tax only on income derived from Antigua). Overall, Antigua offers crypto investors complete tax freedom and a regulatory framework that’s encouraging but not restrictive – aligning well with the island’s overall reputation as a friendly jurisdiction for international finance.

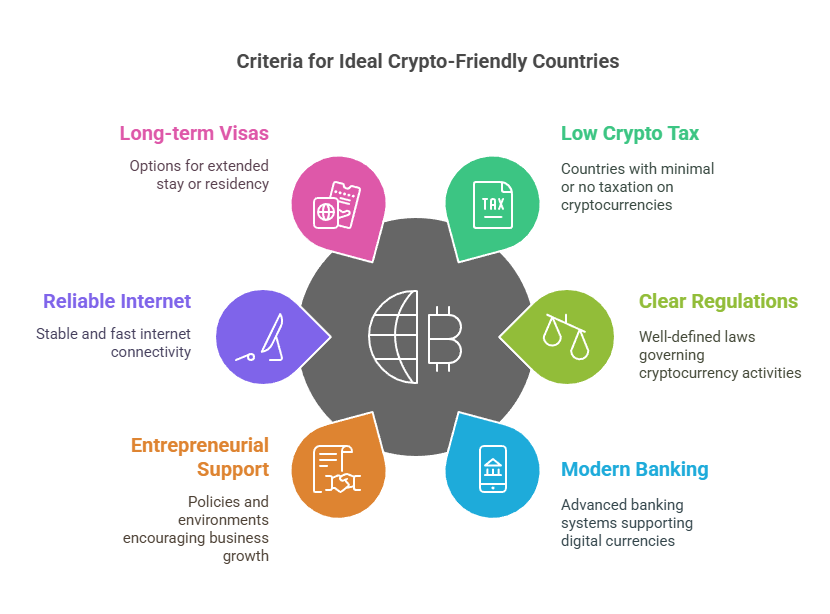

What Makes a Country Crypto-Friendly?

A country is considered crypto-friendly if it offers a favorable regulatory environment, low or zero taxes on crypto transactions, and supportive government policies towards blockchain and cryptocurrency innovation. These characteristics create an ecosystem where crypto businesses and investors can thrive.

Key attributes of a crypto-friendly country include:

Favorable Tax Policies: Countries with low or zero capital gains tax on crypto transactions are highly attractive to investors. For instance, nations like Portugal and El Salvador offer zero capital gains tax on long-term crypto holdings, making them ideal for those looking to maximize their crypto profits.

Clear Regulatory Frameworks: A well-defined and supportive regulatory framework is crucial. This includes clear guidelines for crypto businesses and investors, ensuring that they can operate without fear of sudden legal changes. Estonia and Malta are examples of countries with transparent and supportive crypto regulations.

Stable and Secure Environment: A stable political and economic environment is essential for the security of crypto transactions and investments. Countries like Switzerland, with its renowned stability and security, provide a safe haven for crypto assets.

Active Crypto Community: A strong and active crypto community fosters innovation and provides networking opportunities. Countries with vibrant crypto communities, such as Singapore and the UAE, offer a collaborative environment for crypto enthusiasts.

Government Support: Government initiatives and support for blockchain and cryptocurrency innovation can significantly boost a country’s attractiveness. For example, Malta’s government has actively promoted itself as the “Blockchain Island,” encouraging crypto businesses to set up operations there.

By considering these factors, investors can identify the most crypto-friendly countries that align with their investment goals and strategies.

Choosing the Right Country for Crypto Investments

Each of these countries offers a unique blend of visa access, tax advantages, and lifestyle. For example, if your priority is tax-free crypto in a cosmopolitan setting, the UAE or Portugal (for long-term holders) are prime choices. If you want a quick, low-cost base in Europe, Georgia or Estonia stand out. Those seeking a tropical climate with tax freedom might lean towards Panama, Antigua, or El Salvador, depending on whether Latin American vibrancy or Caribbean tranquility is preferred.

When choosing a country for crypto investments, it’s essential to look beyond just tax breaks. Several factors can influence the decision, ensuring that the chosen country aligns with both personal and financial goals.

Personal Goals: Consider lifestyle preferences, such as climate, culture, and language. Legal requirements, such as visa and residency options, are also crucial. For instance, Portugal offers a Digital Nomad Visa that provides a pathway to residency and eventual citizenship.

Economic Stability: A country’s economic stability and reputation for being crypto-friendly are vital. Countries like Switzerland and Singapore are known for their robust economies and supportive crypto environments.

Regulatory Clarity: Ensure that the country has a well-defined regulatory framework for crypto. Clear regulations help avoid legal uncertainties and provide a secure environment for investments. Estonia and Malta are examples of countries with transparent crypto regulations.

Residency Options: Look for countries that offer attractive residency or citizenship programs. The UAE, for example, provides various long-term visa options for investors and entrepreneurs.

Financial Services and Infrastructure: A strong financial infrastructure, including crypto-friendly banks and payment services, is essential. Countries like Georgia and Panama offer easy banking solutions and integration with international financial systems.

Community and Networking: A vibrant crypto community can provide valuable networking opportunities and support. Countries with active crypto scenes, such as the UAE and Singapore, offer numerous events and meetups for investors.

Legal Compliance: Consider the ease of legal compliance, including reporting requirements and anti-money laundering laws. Ensuring compliance helps avoid potential legal issues and penalties.

By evaluating these factors, crypto investors can choose a country that not only offers tax advantages but also supports their overall investment strategy and lifestyle preferences.