Tbilisi, the capital of Georgia, has emerged as one of the most attractive real estate markets in Eurasia for property investors and foreign investors. With relatively low property prices by international standards and a rapidly growing economy, Tbilisi offers a rare combination of residency-by-investment benefits and strong return on investment (ROI) potential. In recent years (especially post-2022), the city has experienced unprecedented demand and price growth – some districts saw price increases of over 30% in a single year. At the same time, rental yields remain high, and the government welcomes investors with straightforward property ownership laws and residency incentives. This article serves as a comprehensive guide for foreign investors, expats, and high-net-worth individuals considering Tbilisi real estate investment. We will explore Georgia’s residency by investment options through real estate (including legal thresholds, steps, and requirements), current market conditions and trends in Tbilisi’s property market, and analyze ROI with data on prices and rental yields.

Residency by Investment in Georgia: Real Estate Pathways

Georgia offers a residency-by-investment program that is particularly attractive to real estate buyers. Foreigners can purchase real estate in Georgia (except agricultural land) with the same rights as local citizens, and property ownership above certain thresholds can qualify for legal residency.

Georgia’s property registration system is efficient and ensures that all relevant information, including ownership and financial claims, is accurately recorded in the Property Register.

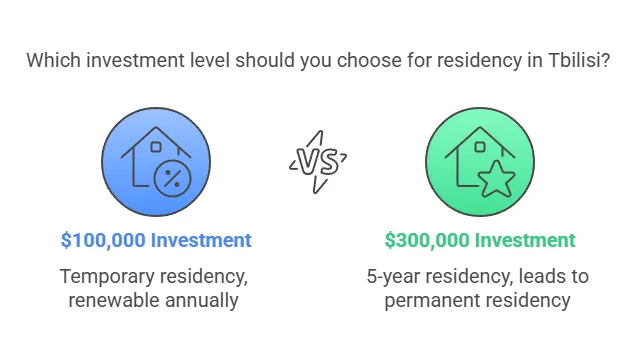

There are two main tracks for obtaining residency through real estate investment:

Temporary Residence Permit (Property Investment of $100,000+)

If a foreign investor purchases non-agricultural real estate in Georgia with a market value exceeding $100,000 USD (or equivalent in Georgian Lari), they become eligible for a Short-Term Residence Permit. This is essentially a temporary one-year residency that can be renewed annually, provided you maintain ownership of the property and its value is still above the threshold. Key points about this option:

Minimum Investment: $100,000 USD in real estate (can be one property or a portfolio of properties that together exceed the threshold). An independent certified appraiser must assess the property and certify that its market value meets or exceeds $100k. (Note: As of 2024, approval rates for property-based residency have improved, with ~70–80% approval, provided all documents are in order.)

Residency Duration: Initially issued for 1 year. You must then renew it each year by re-submitting proof of property ownership and a new valuation confirming the $100k+ value. There is no requirement to live in Georgia full-time to maintain this permit, but you must not sell the property. If the property is sold or falls below the threshold in value, the residence permit becomes invalid.

Family Reunification: After the investor’s permit is approved, immediate family (spouse and dependent children) can also apply for residency under family reunification, co-terminus with the investor’s permit. This makes it convenient for expat families to relocate.

Path to Permanent Residence/Citizenship: The $100k property route is a temporary residency. However, if you continuously renew and maintain legal residency in Georgia for 10 years, you become eligible to apply for permanent residency (and eventually citizenship after 10 years of residency, subject to language and history tests). In other words, the $100k investment doesn’t grant permanent residence immediately – it’s a yearly permit that can lead to permanent status after a decade of uninterrupted residency. (By contrast, as we’ll see next, a larger investment can shorten this timeline.)

Steps to Obtain the $100k Property Residence Permit:

Purchase Property: Identify and buy qualifying real estate in Georgia worth >$100,000. Ensure the title is registered in your name (foreigners can buy freely; no special permit required to purchase). Typically, investors focus on apartments or commercial units, since agricultural land is excluded. Ensure that the property is registered in your name through Georgia’s property registration system, which assigns a unique cadastral code to each property.

Obtain an Appraisal: Hire a certified Georgian appraiser (accredited by the Unified National Accreditation body) to evaluate the property and issue an official report certifying the market value is above $100,000. This document is crucial for the application.

Prepare Documents: Gather required paperwork: passport copy, proof of legal entry or stay in Georgia (you should apply while in Georgia; first-time applications must be from inside the country), the property registration extract (deed) showing you as owner, the appraisal report, passport photos, and the government application form/fee receipt. (If including family members in a later reunification application, also prepare marriage/birth certificates, etc., duly apostilled).

Submit Application: Apply at the Public Service Development Agency (a branch of the Justice Ministry) or a Public Service Hall in Georgia. The application can be submitted by you or via a legal representative. Pay the applicable fee (standard processing is about 30 calendar days). Expedited processing (15 or even 10 days) may be available for a higher fee.

Approval and ID Card: Upon approval, you receive a one-year residence permit. You can then obtain a Georgian residence card (ID). With this ID, you enjoy resident rights (e.g. local bank account, stay in Georgia without visa, etc.). Your family members can then apply for residency through reunification, presenting proof of kinship.

Renewal: Continue to own the property and each year get a new appraisal to prove it’s still worth $100k+ and renew the permit for another year. There is no limit to renewals, except that a temporary permit cannot exceed 12 years in total duration. By year 10, you can apply for a permanent residence (or citizenship) if you meet all conditions.

This temporary investment residence route is popular for those who wish to buy property in Georgia as a holiday home or rental investment and gain the ability to live in the country. It’s relatively low-cost compared to other countries’ “golden visa” programs (e.g., many EU countries require €250k+). Georgia’s $100k threshold is quite accessible and was raised from lower amounts in recent years to ensure investors buy higher-quality assets. The benefit is a flexible residency: you are not obliged to reside full-time in Georgia to keep the permit, making it convenient for investors who may only spend part of the year in Tbilisi.

Investment Residence Permit (Property Investment of $300,000+)

For investors able to spend more, Georgia offers an Investment Residence Permit (often regarded as a “Permanent (5-year) Residence” track) for a $300,000 USD investment in Georgia. In the context of real estate, this means purchasing one or more non-agricultural properties with a total value above $300k. The key advantages of this route are a longer initial residency term and a faster path to permanent residency. Notably, the law was updated in July 2019 to set this $300k category.

Minimum Investment: $300,000 USD in Georgian real estate (or alternately, $300k invested via a Georgian company or other economic activity). As with the $100k permit, an appraisal is required to confirm the market value if it’s a property purchase. Multiple properties can sum to this amount. This threshold is significantly higher, targeting high-net-worth investors.

Residency Duration: The initial permit is issued for 5 years (often referred to as a long-term temporary residence). Importantly, after holding the investment and permit for the 5-year term, the investor becomes eligible for permanent residency in Georgia, provided they still meet the conditions (i.e. still own the property and, if through a business, have met certain financial turnover requirements). In practice, this is a “fast track” to permanent residence – you don’t have to wait 10 years as in the $100k case, but only 5.

Family Inclusion: The $300k investment permit typically covers the principal investor and qualifying family members (spouse and minor children) from the start. They all receive 5-year residency cards, making it a true “golden visa” style program.

Conditions: If the investment is purely real estate, the main condition is not selling or reducing your real estate holdings below $300k during those 5 years. If the investment is via a business/company route, there are additional requirements (the law mandates minimum annual turnover of the company: e.g. $50k in year 1, $100k in year 2, $120k/year in years 3-5) to maintain the residency. For pure real estate investments, Georgia does not impose any annual tax or fee on holding the property – in fact, there is no property tax for individuals on residential property in Georgia, which makes holding a $300k asset relatively low-cost compared to many countries.

Upgrade to Permanent: After 5 years, if all conditions are satisfied (e.g., you still own the property), the government will grant a Permanent Residence Permit. Permanent residency in Georgia has an indefinite duration – you won’t need to renew annually or every 5 years. It also puts you on a path to citizenship; after 10 years of total residency (temporary + permanent) you can apply for Georgian citizenship, subject to language and history tests.

Process for the $300k Investment Residence: The steps are similar to the $100k case, with differences in timeline:

Purchase qualifying properties totaling >$300,000 and get an official appraisal report.

Ensure that the property is registered in your name through Georgia’s property registration system, which provides proof of ownership once the new owner’s details are officially registered.

Submit the residency application (you can often use an expedited process given the high investment; sometimes these applications are prioritized). Approval usually takes about 30 days as well.

Upon approval, you receive a 5-year residence permit card for yourself and family. There is no need for annual renewals, but authorities may require proof that you continue to hold the investment each year (typically monitored through the Public Registry – if you sold the property, you’d violate terms).

After five years, apply to convert to permanent residency (which is generally granted as long as you didn’t withdraw the investment in the interim). At this stage, you essentially have a “green card” equivalent in Georgia.

This $300k route is essentially Georgia’s version of a “golden visa”. Compared to programs in other countries, it’s quite straightforward – no donation required, no stringent physical presence rule (you are not forced to live in Georgia; you just maintain the investment), and the amount is relatively low for a permanent residency (for comparison, some EU golden visas require €500k in real estate). Georgia has no direct citizenship by investment program, but this residency can lead to citizenship over time if that’s a goal.

Benefits of Georgian Residency for Investors: Beyond the right to live in Georgia, these investment residencies offer practical perks:

Visa-Free Travel & Location: Georgia’s residence permit allows you to reside in a country that is a crossroad of Europe and Asia. You can enter and exit freely and enjoy visa-free access to neighboring countries (Georgia itself allows visa-free short visits from many countries, but residency lets you stay indefinitely). While Georgian residency isn’t an EU residency, Georgia has a visa-free regime with Schengen countries for its citizens and is pursuing closer ties with Europe.

Business and Banking: As a resident, opening local bank accounts, registering businesses, and handling transactions is easier. Georgia’s banking sector is robust, and residency can simplify larger financial moves (for instance, you can get loans or mortgages locally). According to investment advisors, Georgia’s business environment is very friendly (7th in the world for Ease of Doing Business).

Tax Advantages: Georgia has a territorial tax system and generally no property tax on residential real estate held by individuals. Rental income is taxable at a flat rate (typically 5% for individuals on residential rent under a special regime), but there are legal ways to optimize taxes (e.g., registering under a small business status). As a resident, you can also benefit from Georgia’s relatively low cost of services and utilities.

High Quality of Life: Many investors choose to live in Tbilisi for its vibrant culture, safety, and low cost of living. Having residency means you can come and go as you please, enroll kids in local or international schools, etc. Georgia imposes no minimum stay – you could reside elsewhere and keep the permit by maintaining your property. This flexibility is a big selling point.

In summary, buying property in Tbilisi not only gives you a tangible asset with appreciation potential, but also a foothold in Georgia through residency. Whether you opt for the $100k route (annual renewals) or the $300k route (long-term from the start), Georgia’s residency-by-investment program in 2024/2025 remains one of the more accessible and investor-friendly in the region. Next, we’ll turn to the investment side of the equation: what kind of ROI can you expect on Tbilisi real estate?

Tbilisi Real Estate Market Overview

Market Growth and Trends: Tbilisi’s property market has been on a strong upswing in recent years, attracting property investors from around the world. After modest growth from 2016 to 2021, the market surged in 2022 and early 2023 – partly due to an influx of foreign residents and heightened demand for housing. Some districts saw price jumps of +35% post-2022. This surge reflects Tbilisi’s growing appeal and a spike in demand, as many Russians, Belarusians, Ukrainians, and other expats relocated to Georgia in 2022 (amid regional turmoil), driving up both sale prices and rents.

By 2024, the pace of growth stabilized somewhat. According to Galt & Taggart research, the average sale price in USD on Tbilisi’s primary market (new development sales) was up 11.6% year-on-year in 2024, a slower rate than the extraordinary growth of 2022–2023. Prices remained high but were increasing at about 0.5% per month in late 2024, compared to 1.5% per month during the 2022-23 peak. The total market value of apartments sold in 2024 reached $3.13 billion, up 7.1% from the previous year, indicating a still-expanding market. In terms of transaction volume, 2024 was roughly on par with 2023 (+2% in total units sold), suggesting steady demand. Notably, foreign buyers have become a significant segment – for example, in the first half of 2024, around 24% of new apartment sales in Tbilisi were to foreign citizens (with particularly growing interest from Israelis).

Current Price Levels: Property prices in Tbilisi vary widely by district and property type. Overall, Tbilisi remains affordable compared to Western capitals – it’s “one of five capital cities where you can buy city-center real estate for under $1,000 per square meter” as noted by some investment experts. However, in prime central districts, prices are higher. By late 2024, citywide average asking prices were around $1,200 per square meter for apartments. In December 2024, for example, the average listing price was $1,223 per sqm, up 1% year-on-year.

The most expensive areas are Mtatsminda (the Old Town/historical center on the slopes) and Vake (an upscale district), where average sale prices stood around $2,000 per sq.m at the end of 2024. On the other hand, more suburban districts like Didi Digomi or Samgori can have prices well under $1,000 per sq.m. Below is a breakdown of typical apartment prices in key Tbilisi districts (as of 2024–2025):

| District | Typical Price (USD per m²) | Description |

|---|---|---|

| Saburtalo | $900–$1,500 (avg. mid ~$1,200) | A large inner-city residential/commercial district with a mix of Soviet-era buildings and new developments. Modern suburbs like Saburtalo have seen rapid growth; prices here are mid-range, and it’s popular for local professionals and students (near major universities). |

| Vera | ~$1,560 on average | A trendy, central neighborhood adjacent to Mtatsminda, known for its bohemian vibe, cafes, and renovated historic buildings. Vera is slightly cheaper than Vake but more central; limited new construction keeps supply low. |

| Vake | $1,200–$2,000 (avg. ~$1,500) | An affluent district known for upscale properties, embassies, and proximity to Vake Park. Vake’s housing stock includes modern luxury high-rises and older high-end flats. It commands premium prices, approaching $2,000+/m² for new units. |

| Mtatsminda | $1,500–$2,500 (avg. ~$2,000) | The historic “Old Town” hill district (including Sololaki, Rustaveli Avenue area) popular with tourists and expats. It has classic 19th-century architecture and panoramic city views. Limited space and high demand make it one of the priciest areas. |

| Old Tbilisi | $1,000–$2,000 (varies by sub-district) | Refers broadly to the historic city center (e.g., Abanotubani, Avlabari on the east bank). Some parts of Old Tbilisi are being redeveloped. Prices can range widely: renovated tourist-zone properties are expensive, while some older stock remains cheaper due to condition. |

As shown, districts like Mtatsminda/Old Tbilisi and Vake are at the high end of the market, often $1,500–$2,500 per m². Saburtalo represents the middle tier (~$1,000–$1,300/m² on average), offering newer condos at reasonable prices. Vera falls between middle and high end, combining central location with slightly less expensive stock than Vake. Outer areas (not listed above, e.g. Didi Digomi, Gldani) can be $600–$800/m² for older apartments, which is why many investors are attracted – Tbilisi real estate is still relatively cheap for a capital city in absolute terms. In fact, a comparison by InvestAsian in 2023 noted “about $2,000 per sqm in city center… Vake is the most expensive neighborhood, followed by Vera and Saburtalo”. Our data confirms that hierarchy, though absolute prices have shifted slightly upward by 2025.

Supply and Construction: On the supply side, Tbilisi has seen a construction boom. After a record year in 2023 for permits, there was a slight dip (~-6.7% in total residential construction area permitted in 2024), but building activity remains robust. New apartment complexes are rising especially in Saburtalo, Didi Digomi, and emerging areas. However, the pipeline slowed a bit due to higher construction costs and developers becoming cautious in 2024. The market is gradually absorbing the new supply, and a balance is being maintained: occupancy rates of completed new projects are high (many projects in 2024 were 80-90% sold by completion).

One interesting trend: a slight shift in buyer preference toward ready (turn-key) apartments versus units under construction. In late 2024, secondary market sales (finished apartments) held up better than presales of new builds. Uncertainties (political and economic, including a pre-election environment in late 2024) made some buyers opt for immediate, tangible properties rather than wait for construction. This means investors looking for rental income might find good opportunities in purchasing finished units that can be rented out right away, rather than pre-construction deals (though the latter can still yield capital gains if bought at early-stage prices).

2025 Outlook: Analysts project a slight softening in demand in 2025 due to factors like domestic political risk, a projected economic growth slowdown, and a possible depreciation of the Georgian Lari. Additionally, rental yields have normalized down from their 2022 highs (more on this next), which could temper speculative buying. That said, Georgia’s macro outlook remains fairly positive and the real estate market “strong and stable” heading into 2025 according to industry observers. Price growth may moderate, but is expected to remain in positive territory, particularly as Georgia continues to attract foreign investment and residents. The Georgian government’s continued infrastructure investments (roads, transit, etc.) and favorable business environment will likely support real estate values. For example, ongoing projects to improve Tbilisi’s public transport and new bypass roads are increasing the appeal of certain districts, which in turn boosts property prices in those areas.

In summary, the Tbilisi property market 2024/2025 can be characterized as cooled from a boil to a simmer. Investors can no longer expect 30% overnight price jumps, but moderate growth on top of an already high base. Importantly, rental demand remains very strong, which brings us to ROI considerations.

ROI Analysis: Rental Yields and Income Potential in Tbilisi

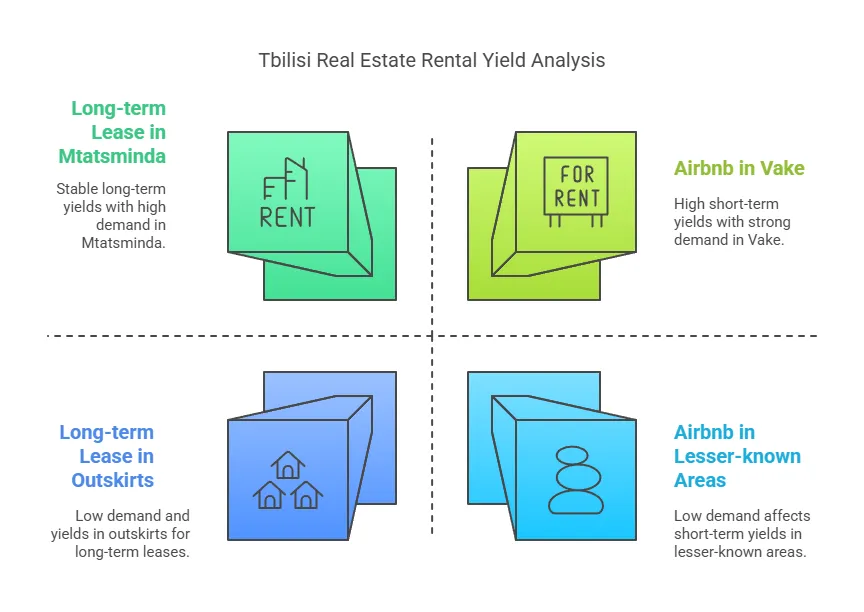

A major draw for property investors in Tbilisi is the high rental yield. Rental yields represent the annual return on property from rent, as a percentage of purchase price. In Tbilisi, both long-term rental and short-term (Airbnb) markets are active, giving investors multiple strategies to generate income.

Long-Term Rentals (typically 1-year leases to local or expat tenants): Gross rental yields in Tbilisi for long-term rentals average around 6% to 8% in 2024, which is quite attractive by international standards. This means if you buy an apartment and rent it out traditionally, you might earn roughly 7% of its value in rent per year (before expenses). Smaller apartments tend to yield higher percentages (as they are cheaper to buy per m² but rent for more per m²). For example, a recent analysis (Q1 2025) showed an average yield of 7.53% across Georgia, with Tbilisi studios and one-bedrooms often in the 6–7% range. In Saburtalo, a typical 1-bedroom apartment (~50–60 m²) costing around $100,000 can rent for about $580 per month, which is a ~6.8% annual yield. In Vake, because purchase prices are higher, yields are a bit lower – a $180,000 one-bedroom might rent for $800/month, yielding ~5.5%. This is corroborated by global property data: high-end districts like Vake and Mtatsminda yield ~5–6%, whereas more affordable districts (or larger apartments in less prime locations) can yield above 8%. In fact, extremely inexpensive areas like Didi Digomi can show double-digit yields (a small studio there might cost ~$40k and rent for $345/month, over 10% yield), although absolute rent sums are low.

Several factors contribute to strong long-term rents in Tbilisi: a growing population (including expatriates from Russia, Middle East, etc.), the return of students to universities, and limited high-quality rental stock. Rents spiked in 2022–2023 (reports showed average rental prices were up 119% year-on-year in Jan 2023 due to the sudden influx of foreigners). By 2024, rents cooled slightly from that peak. The average rent in Tbilisi in late 2024 was around $10 per m² per month. For instance, a 55 m² apartment rents for roughly $550. This was about 9% lower than the rent peaks of early 2023, but still much higher than pre-2022 levels. Even with the slight decline, the citywide average gross yield (using those average rents vs. average prices) was around 10% in mid-2024 – however, that figure likely assumes full occupancy and doesn’t account for expenses, so a more conservative average would be ~7–8% as mentioned. It’s worth noting that yields in Tbilisi are higher than many Western cities because property prices are relatively low while rents (driven by expat demand) are somewhat inflated relative to local incomes.

Short-Term Rentals (Airbnb): The tourism boom in Georgia (nearly 8 million international arrivals annually pre-pandemic) and the popularity of Tbilisi as a digital nomad hub have made short-term rentals a lucrative option. Gross yields from short-term renting can be higher than long-term, albeit with more operational effort and variability. Typical Airbnb rental yields in Tbilisi can range from 12% up to 18% per annum (gross) assuming good occupancy. A LinkedIn real estate guide notes that short-term rentals can yield up to 20% in some cases – this is feasible for prime properties managed well in peak tourist seasons, but 12–15% is a more common range for successful hosts.

To illustrate: According to Airbtics analytics, a “typical” Airbnb listing in Tbilisi had a 60% occupancy rate and an average daily rate of $38 in 2023. That translates to about 219 nights booked per year and ~$8,000 in annual rental income for an average one-bedroom unit. If that property was purchased for, say, $70,000–$80,000 (which is feasible for a 1BR in the city center), the gross yield would be ~10–12%. Many hosts do even better: skilled operators who optimize their listings can achieve 70-80% occupancy or higher. If you manage to rent, for example, 25 days a month at $40 a night, that’s $1,000/month or $12,000/year – on a $80k property that’s a 15% gross yield. During high season (summer and autumn), daily rates can spike, and popular neighborhoods in Old Tbilisi and Vera can be booked out. It’s not uncommon for centrally located, nicely renovated apartments to generate $1,200+ per month on Airbnb during peak periods, which far exceeds long-term rental rates. On an annualized basis, short-term renting in the most sought-after areas (Mtatsminda, Sololaki, Vera) tends to outperform long-term leasing in terms of ROI.

Of course, one must account for costs: short-term rentals incur expenses like management fees (if you hire a property manager or use Airbnb agency), utilities, cleanings, and periods of vacancy. After expenses, net yields might be somewhat lower, but still generally above long-term net yields. The good news in Tbilisi is that regulation on short-term rentals is lenient – currently there’s no strict enforcement requiring licenses for Airbnb hosts, unlike many European cities. This could change in the future, but as of 2024 there are thousands of active Airbnb listings in Tbilisi (nearly 7,000 active listings as of Sept 2024), and the environment is host-friendly. A backup plan is that, if short-term tourism demand dips or regulations tighten, the property can always be switched to a long-term rental (which is considered a stable fallback, even if at a lower yield).

Capital Appreciation: ROI isn’t only about rental income. Appreciation (increase in property value) is the other component. Investors in 2022–2023 saw significant capital gains as mentioned. For example, if you bought in early 2022 in Saburtalo and sold in mid-2023, you could have realized 25-30% appreciation due to the market surge. Going forward, price appreciation is expected to be more modest. Forecasts by local experts suggest low double-digit or high single-digit percentage annual growth in the near term, barring any major geopolitical shocks. Even a conservative 5% annual appreciation paired with a 7% rental yield means a potential total return of ~12% per year, which is compelling. Some areas undergoing gentrification (e.g., certain parts of Old Tbilisi where new hotels and tourist infrastructure are coming, or up-and-coming suburbs where new transit links are planned) might outperform the average in appreciation. It’s wise for investors to keep an eye on urban development plans and invest slightly ahead of the curve in neighborhoods that are improving.

Case Study – ROI Example: To tie it together, consider an investor who buys a 55 m² apartment in Saburtalo for $1,300/m² (about $71,500). They furnish it and list on a mix of long-term and short-term basis: perhaps they secure a long-term tenant for half the year at $550/month, and do Airbnb in the summer high season. Their gross annual rent might be around $8,000–$9,000. This is roughly a 12% gross yield. After paying utilities, maintenance, and management, the net yield might be ~9%. Meanwhile, the property itself might appreciate to $80,000 over a couple of years (say 5-6% annual growth), adding an extra ~$4k in equity per year on paper. Combined, that’s a very strong ROI, rivaling stock market returns – with the bonus that by maintaining this investment, the owner can renew their Georgian residency permit annually (if it’s their $100k property for residency, they likely bought a second small unit or a slightly larger property to meet the threshold, but the principle stands). Now compare a Vake luxury apartment purchase: an investor pays $2,000/m² for a 80 m² high-end apartment ($160,000). They find an expat tenant at $1,000/month. That’s $12k/year, a 7.5% gross yield, and maybe 5% net after taxes and fees – lower, but the property might appreciate in absolute terms and could be used for personal use (Vake being a very comfortable area for self-living). Additionally, that single property qualifies them for the 1-year residency (it’s above $100k). If they instead bought two units in Vera for $80k each, they might rent each on Airbnb for $700/month (averaged) yielding $8,400 per unit/year, which is 10.5% each; together $16,800/year on $160k investment (~10.5%), plus those two units’ combined value ~$160k also meet the residency threshold for a one-year permit. These scenarios show the flexibility – one can optimize for yield (cheaper units in high-rent areas) or for capital growth and lifestyle (blue-chip properties in prime districts).

Rental Yield by District: Yields inversely correlate with purchase price to some extent. To give a sense: Saburtalo and Vera often yield a bit higher because purchase prices are moderate while rents remain robust. Vake and Mtatsminda yield slightly lower on long-term rentals (5-6%) because of the price premium. However, those expensive districts can yield extremely well on short-term rentals thanks to tourist demand – a charming Old Tbilisi/Mtatsminda apartment might fetch $50-70 a night on Airbnb. According to an investor guide, “districts like Vera, Sololaki, and Mtatsminda are popular for real estate investment due to their central locations and high rental yields”, underscoring that the city center can produce excellent cashflow if leveraged in the short-stay market. Meanwhile, areas slightly further out (Saburtalo, Krtsanisi, etc.) have reliable long-term tenant pools (students, young professionals, expat workers), supporting the 6-8% yields.

The table below summarizes estimated gross rental yields in the highlighted districts for both long-term and short-term strategies:

| District | Est. Gross Rental Yield (Long-Term) | Est. Gross Rental Yield (Short-Term) |

|---|---|---|

| Saburtalo | ~7% (typical range 6–8%) | 12–15% (with good Airbnb occupancy) |

| Vera | ~7–8% (high demand vs. moderate prices) | 15% or more (popular area for Airbnb due to nightlife; smaller units perform well) |

| Vake | ~5–6% | ~10% (appeals to long-stay visitors and expats more than tourists) |

| Mtatsminda | ~5–6% (luxury long-term rentals) | 15–18% (prime tourist location, can charge premium rates in peak season) |

| Old Tbilisi | ~6–7% (varies by sub-location) | ~15% (very high short-term demand in historic quarter) |

These figures are gross yields; net yields after expenses will be a few points lower. Nonetheless, Tbilisi’s ROI profile is strong. For context, a 6-8% rental yield in a capital city is exceptional – many Western European capitals offer only 2-4% yields by comparison. And few markets in the world allow >10% yields via short-term rentals as Tbilisi does, without heavy regulation. This is why “Tbilisi real estate investment” has become a buzzword among yield-seeking investors and why real estate consultants often highlight Georgia as a high-return property market.

High-ROI Neighborhoods in Tbilisi: District Insights

Tbilisi is a city of distinct neighborhoods, each with its own character and investment profile, making it attractive for property investors. Here we provide detailed insights into five key districts frequently cited for their ROI potential and popularity among foreign investors: Saburtalo, Vera, Vake, Mtatsminda, and Old Tbilisi. We’ll look at what makes each area appealing, current price levels, and the kind of rental returns you might expect.

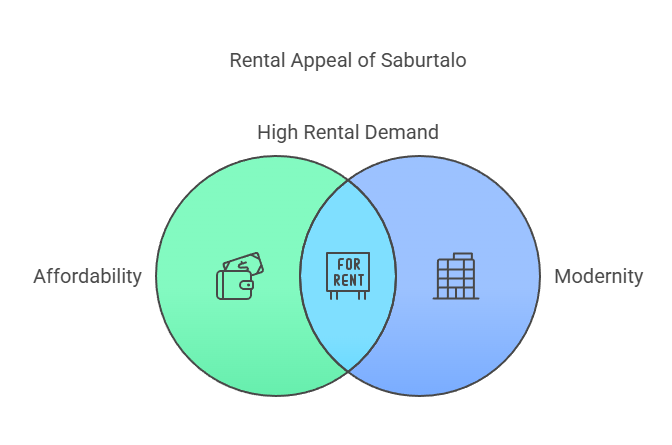

Saburtalo

Profile: Saburtalo is a large district in north-central Tbilisi that has seen tremendous development, making it attractive for property investors. Historically a Soviet-era residential area, it is now filled with new high-rise apartments, shopping centers, universities (Tbilisi State University’s main campus and others), and corporate offices. Its central location (just west of the city core) and relative affordability make it one of the first choices for both local buyers and expats.

Property Types & Prices: Saburtalo offers everything from old Soviet block apartments to brand-new luxury condos. New builds in Saburtalo average about $970/m² as of early 2025, while older flats might go for ~$800–$1,000/m² depending on condition. Mid-tier modern apartments typically range $900–$1,500 per m². For example, a renovated 1-bedroom 50m² might list around $60k–$70k. This mix of reasonable prices and new supply means investors can find good deals here even in 2025.

Rental Demand: Extremely strong. Saburtalo’s rental market is buoyed by students (local and international) and young professionals. Many tech companies and banks have offices in the area, making it convenient for employees to live nearby. Long-term rental yields are solid ~7% on average here, as noted earlier. A typical rent would be about $500–$600 for a 1-bedroom and $700–$800 for a 2-bedroom per month (depending on finishes). The volume of renters means vacancies fill quickly, especially for units near the Metro or major streets like Pekini Ave or Kazbegi Ave.

Short-Term Rentals: Saburtalo is less touristy than Old Town, but there is still short-term rental activity from business travelers or medical tourists (there are clinics and hospitals in the area). Airbnb yields can reach low double-digits if managed well, but generally slightly lower than the historic center. Think ~12% gross yield potential, with daily rates perhaps $30–$50 for a nice apartment and decent occupancy. Some investors prefer Saburtalo for medium-term rentals (e.g., month-to-month for digital nomads) due to its modern conveniences.

ROI Outlook: Saburtalo offers a balance of moderate price & high rental liquidity. It’s often cited that this district provides “the best bang for buck” for buy-to-let. You can buy two Saburtalo apartments for the price of one in Vake, and the combined rent from those two will usually exceed the rent from one Vake property. With new metro stations planned and ongoing commercial development, Saburtalo’s property values are expected to continue rising steadily. It may not have the highest appreciation spikes (since supply is ample), but it’s a workhorse for rental income. Many foreign investors start here because it’s straightforward: you can get a fully finished, tenant-ready unit in a new building and start collecting rent immediately, with yield ~7-8% easily achievable.

Insider Tip: Look near the major universities (there’s demand from faculty and students for rentals) or near the Tech Park and business centers on Saburtalo axis. Pekini Avenue is a popular address (with lots of shops and restaurants), and the neighborhoods around Medical University metro station, Delisi, and Vazha-Pshavela Avenue are up-and-coming as new projects complete.

Vera

Profile: Vera is a small, trendy neighborhood nestled between Rustaveli Avenue (Mtatsminda) and Vake, making it appealing for property investors. It’s known for its artsy atmosphere – think cafes, wine bars, and a blend of historic houses and modern boutique apartments. Many artists and young professionals favor Vera for its central-yet-local feel. For investors, Vera’s appeal lies in its boutique charm and high rental desirability.

Property Types & Prices: Vera’s housing stock includes early 20th-century brick buildings, some elegant pre-Soviet houses (often refurbished into guesthouses or offices), and a few contemporary mid-rise apartment buildings. Because of limited space, new construction is not as prevalent, which keeps prices relatively high due to scarcity. The average price in Vera is around $1,560/m² for new build apartments (2025). Many properties fall in the $1,300–$1,800/m² range depending on age and renovation status. For instance, a 70m² renovated flat might cost ~$100k. There are also luxury options (penthouses or townhouses) that can exceed $2,000/m², but generally Vera is a tad less expensive than neighboring Mtatsminda or Vake, while being very close to the action.

Rental Demand: Vera is highly sought after by renters. It’s close enough to walk to Rustaveli (the main avenue/downtown), yet quieter and more neighborhood-like. Young expats who work remotely, or locals who want to be near nightlife, often seek apartments in Vera. Typical long-term rents are slightly lower than Mtatsminda – maybe ~$450–$700 for a one-bedroom depending on size, and $800–$1,000 for larger units. That said, because purchase prices are moderate, the yields are actually quite good. We estimate long-term yields in Vera can be ~7-8% for well-priced buys (higher than Vake’s yield). Vera’s advantage is that smaller quirky apartments (like a loft in a historic building) might be relatively cheap to buy but rent for a premium due to location.

Short-Term Rentals: This neighborhood is an Airbnb gem. Tourists like Vera for the authentic Tbilisi experience – charming streets like Gogebashvili or Janashia offer cafes and wine cellars, and Marjanishvili Theatre and Rooms Hotel are nearby landmarks. If you list a stylish apartment in Vera on Airbnb, you can attract both tourists and digital nomads who prefer to avoid the tourist crowds in Old Town but still be central. With the vibrant cafe scene, Vera apartments often boast occupancy rates similar to Old Town. One-bedroom units in Vera can often fetch $40–$60/night on Airbnb. Even if occupancy averages 50-60%, you’re looking at potentially $800-$900 a month revenue, which for a ~$100k property is ~10-11% gross annual. With good reviews and marketing, some hosts push occupancy to 70% which could yield ~15%. The gross yields ~15% are plausible here, aligning with the general short-term yield range mentioned.

ROI Outlook: Vera’s property values have been climbing and will likely continue as the area gentrifies further. It has a finite supply of properties (being a small district), and as more foreigners move in, renovations of old buildings continue, raising values. A potential catalyst is any future redevelopment of older structures into new condos – if that happens, early investors in dilapidated units could see big appreciation. However, even without speculation, Vera is a solid pick for cash flow plus appreciation. It’s often highlighted as having “the charm of Old Tbilisi without the chaos,” making it attractive for mid-term stays as well. This versatility (suitable for Airbnb, yet also for yearlong leases) means investors can toggle their strategy as needed.

Insider Tip: Because Vera has many older structures, do thorough due diligence on the building condition if buying an older apartment. Some might need seismic retrofitting or have shared courtyards, etc. However, those quirks can be turned into selling points (e.g., a historic apartment with original hardwood floors can command premium rents after a tasteful renovation). Streets like Kekelidze, Janashia, and Petriashvili are hot – proximity to the popular Fabrika hostel/cultural space (just over in neighboring Chugureti) and new cafes means the area is only getting trendier.

Vake

Profile: Vake is Tbilisi’s prestige district – often compared to an upscale suburb, making it a prime location for property investors. Though it’s relatively central, it’s known for high-end apartment buildings, diplomat residences, and Vake Park, a large green park that is a focal point of the community. Many wealthy Georgians and expat families reside in Vake, valuing its safety, greenery, and upscale dining/shopping options. For investors, Vake represents the “blue chip” real estate location in Tbilisi.

Property Types & Prices: Vake is filled with modern residential towers and mid-rise luxury buildings. You’ll also find older but spacious Soviet-era apartments (which often have prime spots and still command high prices). Prices in Vake average $1,200–$2,000 per m², with newest luxury developments like Skyline or Bagebi area projects reaching $2,500/m² or more. According to one source, new build averages in Vake are about $1,248/m² – this might seem low for such a prime area, but it likely reflects some projects on the fringes; top-tier buildings in the heart of Vake (near the park or Chavchavadze Ave) are considerably higher. An average 100 m² apartment in Vake can easily be $150k-$200k. Penthouses and large family apartments go into the few-hundred-thousand dollar range.

Rental Demand: Vake’s renter profile skews toward expat professionals (working for embassies, NGOs, multinational companies) and affluent locals. They often seek larger apartments (2-3 bedrooms) and are willing to pay a premium for quality. Long-term rent for a modern 2-bedroom in Vake can be $1,000–$1,500/month (especially if it’s high floor with a view, parking, etc.). A one-bedroom might be $700–$900/month depending on size and finish. However, because purchase prices are high, the yield is a bit lower – roughly 5-6% as noted. Investors who buy in Vake are sometimes more appreciation or lifestyle focused. That said, the tenant quality is usually excellent and contracts are often made in USD or with inflation protection, so it’s stable income.

Short-Term Rentals: Vake is not a typical tourist district, but it does attract a niche of long-stay travelers and business visitors who prefer a quieter, upscale environment. For example, a diaspora Georgian family visiting for the summer might rent a nice apartment in Vake for a month. Or an international school teacher might Airbnb for a few weeks before finding long-term housing. Nightly rates in Vake on Airbnb can be high (luxury apartment = high rate), but occupancy might be lower than Old Town because fewer tourists specifically want to stay in Vake. One might achieve ~10% gross yield via short-term rentals in Vake – for instance, renting a $180k apartment for ~$100/night but only 50% of the time. Often, property owners in Vake go for long-term corporate leases instead of daily churn.

ROI Outlook: Vake real estate is considered a safe investment – it will generally hold value and appreciate over time as Tbilisi grows. It may not produce the highest immediate cash yield, but it’s the kind of property that in 5-10 years could be worth significantly more, especially as land in central Vake is nearly built-out. One future factor: the completion of major projects like the “Vake Hills” development or the potential metro line extension to University/Vake could boost prices. Already, Vake and nearby Bagebi saw price rises after 2022 due to high demand from incoming expats (some of whom outright bought in Vake to live). As Georgia’s economy grows, Vake could see prices approach those of second-tier European cities (some argue it’s still undervalued for a capital city’s prime area). For investors, Vake might be ideal if you plan to use the property personally (a second home) and rent it out when you’re away – you get both a premium residence and some income.

Insider Tip: Look at the Bagebi sub-district (upper Vake) where many new luxury buildings have mountain and city views – popular with wealthy locals, and values there have been climbing. Also, small 1-bedroom units in Vake can actually yield decently (as they’re rare, and young professionals might pay top dollar for them) – a 50m² apartment might rent for $700 which on a $90k cost is ~9.3% gross, not bad at all. So not every Vake investment has to be low-yield; careful selection matters.

Mtatsminda (Old Town)

Profile: Mtatsminda is both the name of the mountain overlooking central Tbilisi and the larger district that encompasses much of the historic Old Town on the west side of the Kura River, making it attractive for property investors. It includes famous areas like Sololaki, Vere, and parts of Rustaveli Ave. This is the heart of old Tbilisi – characterized by 19th-century buildings, narrow cobblestone streets, cafes, galleries, and landmarks (e.g., the Funicular, the Parliament, Freedom Square). Investors are drawn to Mtatsminda for its touristic appeal and prestige.

Property Types & Prices: In the Old Town/Mtatsminda area, you primarily find older buildings – some beautifully restored, others in need of renovation. There are a few new developments (often smaller scale, boutique residences since preserving the historic skyline is important), and those new builds can be extremely pricey (north of $2,500/m² easily). For example, a high-end project might sell units at $3,000+/m² due to the prime location. On average, though, an existing apartment in Mtatsminda ranges $1,500–$2,500 per m² as earlier noted. Many sales here are of older flats e.g. a 80m² in a 1900s building for $130k (if renovated) or perhaps $100k (if it needs work). As a unique segment, historic houses (with courtyards) sometimes come up for sale – those are hard to value but can be gems for boutique hotel conversion or Airbnb if one invests in refurbishment.

Rental Demand: Two distinct markets: long-term and short-term. Long-term, Mtatsminda attracts expat professionals who love the cultural vibe, as well as Georgians who want a prestigious central address. Rents for long-term are high – e.g., a 2-bedroom nicely furnished on Rustaveli could fetch $1,200/mo from an NGO worker or similar. However, given the high purchase prices, the long-term yield might be around 5-6%. Many landlords in this area actually prefer short-term or daily/weekly rentals because of the tourist influx.

Short-Term Rentals: This is Airbnb central. Old Tbilisi (which includes Mtatsminda/Sololaki) is where the majority of tourists want to stay – walking distance to cafes, museums, sulfur baths, etc. There are countless guesthouses and Airbnbs tucked in these streets. As such, competition exists, but also an ever-replenishing supply of guests. It’s possible to achieve very high occupancy, especially in peak summer and during holiday seasons. A well-reviewed apartment with a balcony overlooking the old city can charge a premium – $60-$80/night for a one-bedroom is not uncommon in peak season. Some hosts even charge $100+ a night for large or very stylish units. With occupancy management, many report 15-18% gross yields here. For instance, one might earn $10k-12k per year on a unit that cost $70k if done right (some of that coming from very high nightly rates in short bursts). The short-term rental market in Old Town is so robust that even in winter low season, monthly discounts attract digital nomads to fill units. The key is that properties here “rent themselves” location-wise; marketing a unit as “5 min walk from Freedom Square” or “in the heart of Old Tbilisi” automatically draws interest.

ROI Outlook: Owning property in Mtatsminda/Old Town is a bit like owning in a UNESCO heritage site – long term, it’s almost certain to appreciate due to uniqueness. There is limited capacity for new construction (and strict rules for it), so the existing stock grows more valuable as demand rises. Georgia’s tourism is expected to keep growing in the coming decade, so short-term rental prospects remain positive. If Georgia eventually enters the EU or significantly increases tourism infrastructure, property values in the Old Town could jump considerably as international investors pile in. So the upside could be big. The trade-off is managing the property (short-term rentals are work) or settling for lower yields with long-term tenants. Many investors find a hybrid – rent to tourists for the high season, then find a 6-month tenant for the off-season, etc., to maximize earnings.

Insider Tip: Sololaki (a neighborhood within Mtatsminda district) is particularly favored by foreign investors; it has gorgeous architecture and many buildings are being slowly refurbished. Buying an unrestored apartment there and renovating can significantly boost value and rent. Kikodze, Lado Asatiani, Machabeli streets – these are addresses to watch. Also, check if the building is designated historical – if yes, any exterior changes need approval, but also they often have higher ceilings and attractive old features that tourists love. Parking is scarce in Old Town; apartments with reserved parking spots are gold for long-term renters who have cars.

Old Tbilisi (Historic East Bank and Environs)

Profile: By “Old Tbilisi” here, we refer to the historical areas on the east bank of the river (such as Abanotubani, Avlabari), which are attractive for property investors due to their cultural significance and investment potential. This includes the famous sulfur bath district, the Metekhi church area, and up the hill into Avlabari (which is an older area now seeing lots of new hotel constructions). It also encompasses parts of Chugureti/Marjanishvili which is a 19th-century expansion area with its own character. Essentially, this category is the heritage areas outside Mtatsminda proper. These areas offer a mix of cultural tourism spots and local neighborhoods.

Property Types & Prices: Abanotubani (the bath district) has many small guesthouses and some apartments, often in older brick buildings or newer replicas. Prices can be high right by the baths or along the river because of commercial potential (e.g., a building suitable to convert into a hostel). Avlabari, across Metekhi bridge, historically was a less expensive area (it’s a bit hilly and used to be less developed), but now with the new Presidential Palace and many new hotels, prices have risen. You can still find properties in Avlabari at $1,000–$1,300/m², but closer to Metekhi or in renovated bits of Old Tbilisi, prices move up towards $1,500–$1,800/m². The range $1,000–$2,000/m² as given before holds true, where $1,000 is for perhaps a dingy unrestored unit in Chugureti, and $2,000 for a nicely flipped one in Abanotubani. This “Old Tbilisi” zone is heterogeneous. Also, since the question specifically lists Old Tbilisi separate from Mtatsminda, we cover it to ensure completeness.

Rental Demand: Similar to Mtatsminda, much of the demand is tourist-oriented. Avlabari has several new international hotels, which actually increases the area’s profile for visitors – many tourists now explore the east bank, and some prefer to stay there (there’s a metro station and views of the Old Town from that side). Long-term local demand in these exact historic pockets is a bit lower (many locals prefer newer areas unless they specifically want old-city living). But certain parts, like Marjanishvili and Aghmashenebeli Avenue (a beautifully restored pedestrian street in Chugureti), are very popular with both locals and foreigners, and have strong rental demand. Gross yields for long-term might be around 6-7% in these areas – for example, a $80k apartment near Marjanishvili might rent for $450 (which is ~6.7%). In Avlabari, because it’s slightly out of the way, one might rent a similar $80k place for $400, about 6%.

Short-Term Rentals: Old Tbilisi on the east bank (Baths district, Avlabari hillside) is also heavily used for short-term rentals. Tourists love the view of the Narikala fortress which is best seen from east bank balconies. Guesthouses in these areas do brisk business. Airbnb yields can be high here as well, though perhaps not as uniformly as Sololaki/Vera – it depends on the exact spot and property charm. But certainly, an apartment with a view of the river or old town in Avlabari can charge high nightly rates. We can expect ~15% gross yields similar to the other central areas, provided the property is marketed for tourism. Additionally, being slightly outside the busiest tourist zones can be marketed as a plus (quieter, more authentic, etc.).

ROI Outlook: These “Old Tbilisi” areas are in transition. There’s a lot of renovation and foreign investment happening (especially in the Aghmashenebeli Ave area, where many old buildings were renovated in the last decade). The government has shown interest in restoring historic neighborhoods, which boosts property values. For example, Aghmashenebeli’s renewal a few years ago immediately raised property prices there. We anticipate further projects to clean up and develop the eastern Old Town (perhaps more boutique hotels, restaurants in Avlabari, etc.). So appreciation potential is significant if you pick the right micro-location. The risk is that some buildings are in very poor condition or that infrastructure (roads, parking) is challenging, which could cap values until solved. Still, ROI can be excellent – one strategy is to buy a less-than-perfect property in this area at a discount, renovate it into a chic Airbnb and reap very high yields plus an eventual resale profit.

Insider Tip: Marjanishvili/Chugureti – though not listed by the user, this area is technically part of “Old Tbilisi” district administratively and deserves a mention. It’s across the river but north of Avlabari, featuring gorgeous 19th century architecture. It’s becoming a hip area with cafes and bars (some call it “New Berlin” of Tbilisi). Prices here are still relatively low (you can find sub-$1000/m² in some buildings) and yields can be high since young expats love to rent here. If Saburtalo is the safe bet and Vake is the luxury bet, Marjanishvili/Chugureti is the undervalued bet for potentially high ROI. Many foresee this area as the next big thing for investment. For purer Old Town east bank (Avlabari), an insider tip is to get something with a view – tourists will pay more for a terrace overlooking Tbilisi’s landmarks.

Conclusion

Tbilisi’s real estate market in 2024/2025 presents a compelling opportunity for international investors by combining two attractive features: residency privileges and robust ROI. Georgia’s residency-by-investment program is straightforward – with a property purchase of $100,000$300,000, investors can secure legal residency ranging from temporary one-year permits to five-year investment residence permits. These options provide flexibility for expats and high-net-worth individuals seeking a foothold in a politically stable, low-tax, and business-friendly country. The legal requirements (independent appraisal, clean title, etc.) are transparent, and Georgia imposes no ongoing property taxes or onerous obligations on investors. Essentially, you can buy property in Georgia, enjoy residency by investment benefits for yourself and your family, and not be burdened by heavy costs or residency mandates – a major advantage over other investment visa programs.

On the ROI side, Tbilisi stands out with strong rental yields in both the long-term and short-term markets. While property prices have risen from their 2022 lows, they remain moderate by global standards (averaging ~$1,200/m², with luxury at ~$2,000+/m²). Rents, buoyed by expat demand and tourism, provide returns of 6-8% (or more) gross annually for long-term leases. In the short-term arena, Airbnb rentals in Tbilisi can yield over 10-15%, especially in central districts where tourist occupancy is high. Our analysis of neighborhoods – Saburtalo, Vera, Vake, Mtatsminda, Old Tbilisi – demonstrates that investors have options across the spectrum: from Saburtalo’s mid-priced high-yield flats to Mtatsminda’s premium heritage properties that generate Airbnb income. Data-supported examples show one can achieve healthy cash flows; e.g., a $100k Saburtalo apartment can earn ~$7k/year in rent (7% yield), while a well-located Old Town apartment can gross $10k+ on Airbnb (10-15% yield)

Furthermore, Tbilisi offers diversification: you can invest in an emerging market that is not correlated with Western real estate cycles, yet you have a relatively safe legal environment (strong property rights, easy repatriation of funds, etc.). The market outlook for 2025 is cautiously optimistic – growth is steady, and any short-term political noise is balanced by Georgia’s long-term trajectory towards greater global integration and possibly EU candidacy, which could dramatically elevate the market if realized.

From a strategic perspective, an investor might choose Tbilisi to complement their portfolio – for instance, using rental income in USD or GEL to offset expenses elsewhere, or as a hedge against turmoil (as Georgia has shown stability and openness even during regional conflicts). The residency aspect adds a layer of security: having Georgian residency means you have a “plan B” home in a country with a low cost of living and friendly climate, which is an intangible ROI in itself.

As always, due diligence is key. Investors should work with reputable local real estate agents and legal counsel to navigate the purchase process (e.g., ensuring proper property registration and understanding any zoning limitations). Market conditions can evolve, so keeping abreast of the latest 2024/2025 developments (such as any legal changes in residency rules or any significant economic shifts) is prudent. That said, the data and trends as of now paint a favorable picture.

In conclusion, Tbilisi’s real estate sector is ripe with opportunity: whether your goal is to obtain Georgian residency by investment, earn strong ROI through rental income, or both, the city welcomes you with open arms. With the right investment in the right neighborhood, you could be gaining a new home base in Georgia while your property works for you financially. And as Tbilisi continues its rise on the world stage – blending old world charm with new world dynamism – those who invest wisely today may find themselves reaping both personal and financial rewards for years to come.