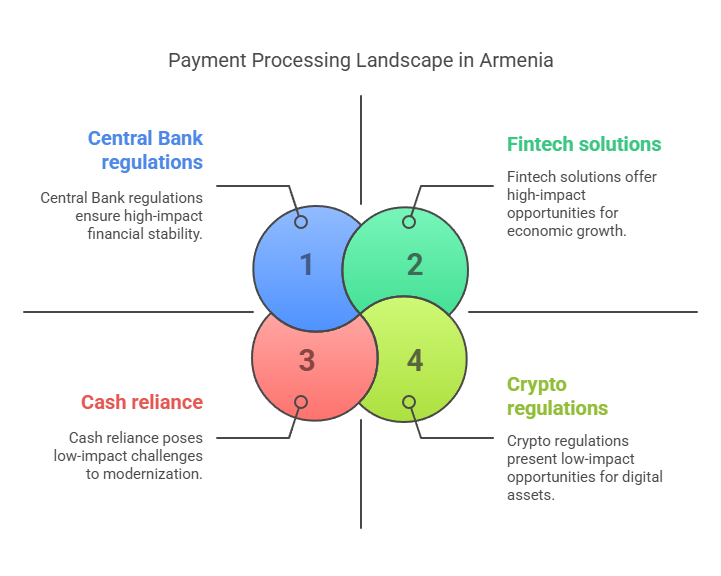

Overview of the Payment Processing Landscape in Armenia

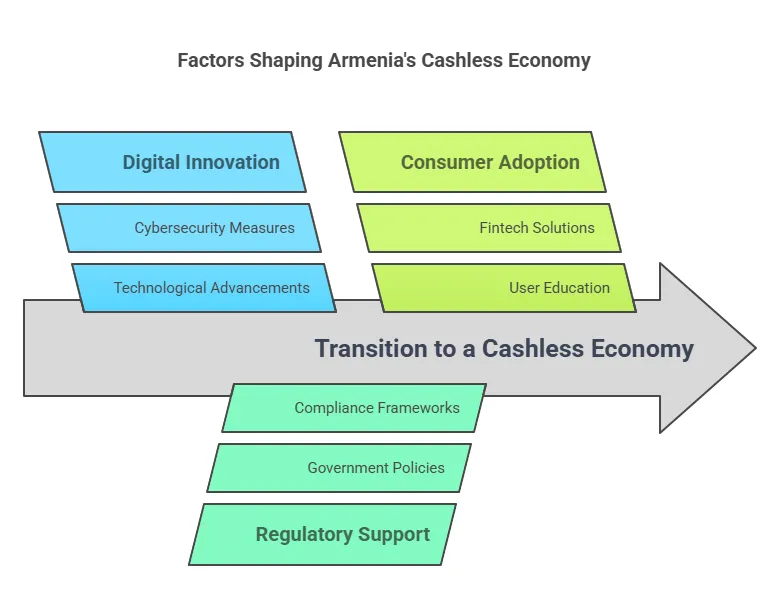

Armenia’s fintech and payment ecosystem is growing rapidly, driven by a young tech-savvy population and proactive government initiatives. The fintech sector is expanding at about 25% CAGR, with mobile banking and digital wallets becoming more prevalent. In fact, digital payment volumes in Armenia exceeded $6.8 billion in the past year, while fintech sector revenues topped $1.6 billion. This surge is bolstered by a nationwide push towards cashless transactions. New laws effective since 2022 require that large purchases (over AMD 300,000, roughly $720) be made electronically rather than in cash. As a result, officials report that non-cash payments now outpace cash payments in Armenia’s economy. Major banks and the government have introduced incentives (like cashback programs and digital ID integration) to encourage cashless payments and e-commerce adoption. Armenia’s Central Bank (CBA) has even established a regulatory sandbox that attracted $90 million in fintech investments, helping boost Armenia to 34th place in the Global Fintech Index.

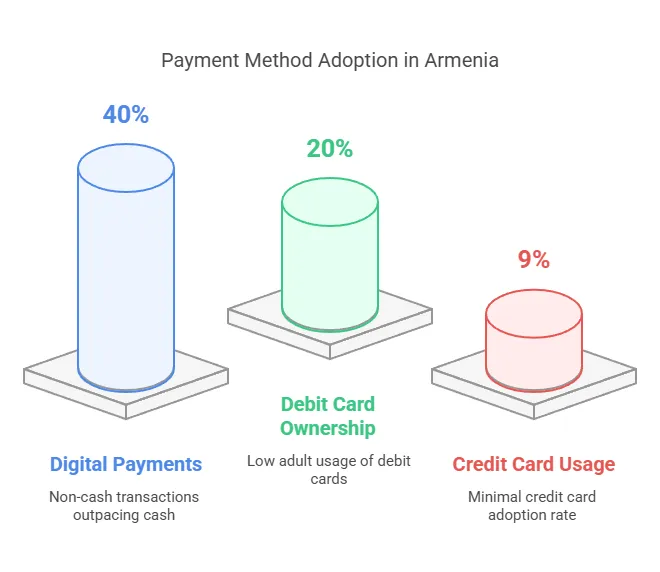

Despite these positive trends, cash still plays a significant role, underscoring both challenges and opportunities. Only about 40% of adults made a digital payment in the last year (showing the remaining dominance of cash in daily life). Fewer than one in five people use the internet or mobile phones to pay bills, and card penetration remains relatively low. This indicates a large untapped market as consumer habits evolve. At the same time, Armenia has over 18 banks and more than 200 fintech companies competing or collaborating to provide modern financial services. Key trends for fintech in Armenia include the proliferation of mobile wallets, contactless payments (Apple Pay/Google Pay), and even early exploration of blockchain and a potential central bank digital currency (CBDC).

Advance payment is also a crucial method in mitigating risks in international transactions, especially for companies new to the market and establishing relationships with Armenian trading partners. Overall, the payment processing landscape is in transition: moving from a cash-reliant economy toward a digitally driven, cashless ecosystem with strong support from both industry and regulators.

Major Payment Gateways in Armenia

Armenian businesses in both B2C and B2B sectors have access to a mix of local payment gateways and international payment platforms for online transactions. Local providers dominate the domestic market, offering interfaces in Armenian and support for the local currency (AMD), while international gateways broaden reach to global customers. Below is an overview and comparison of the major payment gateways in Armenia:

Local Payment Gateways: Armenia’s homegrown payment systems include Idram, Telcell, EasyPay, and the ArCa network. These providers cater to local merchants with Armenian dram processing, broad consumer adoption, and integrations for local banks. Idram (est. 2008) is one of the most popular digital wallet and payment gateway services, with over 1.5 million registered users and 55 million transactions processed in 2022 alone. Idram allows users to pay online and in-store (via QR codes) and offers merchant tools such as e-commerce checkout integration. It’s accepted at 14,000+ retail outlets and over 1,000 online stores in Armenia. Telcell is another dominant player – originally known for its nationwide payment kiosks, it has evolved into a full fintech ecosystem with the Telcell Wallet app and online gateway. Telcell’s user base and transaction volumes have grown explosively (user count multiplied 25× in five years, transaction volume 14×) as the company expanded into digital services. Both Idram and Telcell enable merchants to accept payments via customers’ e-wallet balances, local cards, or even cash-in through their kiosk networks. EasyPay is a similar local system combining kiosks and a wallet app, though on a smaller scale. Meanwhile, ArCa (Armenian Card) is the national payment network that connects local banks – it operates a gateway often called ArCaPay or the ArCa PayCenter. Through ArCa, merchants can accept local ArCa cards as well as Visa/Mastercard issued by Armenian banks, with unified settlement in AMD. To use ArCa’s gateway, a business typically opens a merchant account with a member bank, then integrates ArCa’s payment interface on their website. ArCa’s platform is PCI DSS compliant and supports 3-D Secure (Verified by Visa, etc.), ensuring secure card transactions. The local gateways generally offer lower transaction fees (often in the ~2% range, negotiated per merchant) and faster settlement to Armenian bank accounts (usually within 1–2 business days) compared to global providers. They also provide Armenian-language customer support and are attuned to local needs (e.g. utility bill payments, loyalty programs like Telcell’s BON points marketplace). However, their focus is mainly domestic – for international sales or multi-currency support, Armenian merchants often look to the international gateways.

International Payment Gateways: For reaching global customers or receiving funds from abroad, businesses in Armenia often turn to platforms like Stripe, PayPal, Payoneer, and 2Checkout (Verifone). It’s important to note that Stripe and PayPal are not fully launched in Armenia – there are limitations. Stripe, while renowned worldwide for easy credit card processing, is not available directly in Armenia. Armenian entrepreneurs have found workarounds such as registering a company abroad (e.g. a US or EU LLC) to legally open a Stripe account and then accept payments online. This approach allows use of Stripe’s gateway (with fees around 2.9% + $0.30 per transaction) but comes with extra setup effort. A business owner in Armenia can benefit from platforms like Stripe by establishing a verified account through a business entity in a supported country. PayPal is partially available: Armenian users can create PayPal accounts to send payments (linked to local cards), but they cannot receive PayPal payments directly into an Armenian account. There is no full PayPal merchant support in Armenia yet, due to regulatory compliance requirements. Many freelancers and businesses instead use Payoneer or other means to get paid. Payoneer is very popular in Armenia’s tech and freelance community as a cross-border payment solution – it operates in Armenia and offers multi-currency receiving accounts (USD, EUR, etc.) for local users. With Payoneer, an Armenian freelancer or company can receive international client payments (ACH, SEPA or credit card) into their Payoneer account, then withdraw to a local bank in AMD. Payoneer’s services are fully compliant with local regulations and provide a secure way to get paid globally. The platform’s fees include a percentage for currency conversion and withdrawal (e.g. 2%–3% conversion fee above mid-rate, and a flat fee for bank withdrawals), which users consider acceptable for the convenience. 2Checkout (Verifone) is another key international gateway used in Armenia, especially by e-commerce sites seeking to charge foreign customers’ cards. 2Checkout supports merchants in 200+ countries and can process payments in 100+ currencies, making it a go-to for Armenian businesses without access to Stripe/PayPal. Notably, Ecwid (a global e-commerce platform) recommends 2Checkout and ArCa as options for sellers in Armenia. 2Checkout acts as both gateway and merchant account, settling funds to the business after a payout schedule. Its standard pricing is around 3.5% + $0.35 per transaction, and it accepts major credit cards, PayPal, and others through one interface. Comparing features: Local gateways like Idram/Telcell excel in local market integration (supporting AMD and local payment methods, with low local bank transfer fees), whereas international gateways offer broader currency support and global reach (accepting international cards, offering services like recurring billing or global fraud screening). However, international platforms may have higher fees for Armenian users (PayPal, for instance, charges ~4–5% for cross-border transactions if it were used) and longer settlement times (e.g. 2Checkout’s payouts can be weekly or bi-weekly). Customer support is also a factor – local providers have on-the-ground support teams in Yerevan, while global services provide online support. In summary, payment gateways in Armenia range from local solutions deeply embedded in the market (Idram, Telcell, ArCa) to international services that connect Armenian merchants with the world (Stripe via workaround, PayPal send-only, Payoneer, 2Checkout). Many businesses actually use a combination: a local gateway for AMD transactions and an international one for USD/EUR and overseas customers. This mix ensures coverage of both online payments in Armenia for local clients and convenient international payments Armenia businesses need for global trade.

Digital Wallets and Mobile Payment Solutions

Digital wallets have become a cornerstone of Armenia’s cashless transition, offering mobile-first payment experiences for consumers. The country has seen a surge in mobile payment apps usage between 2020 and 2025, as people increasingly prefer the convenience of paying by phone instead of cash. The leading local wallet apps are Idram and Telcell Wallet, which have mass user adoption. These apps allow users to store funds (as electronic money in AMD), link bank cards, and pay a wide range of bills or merchants instantly. For example, a shopper can scan a QR code at a store checkout to pay via their Idram or Telcell app, debiting their wallet balance or linked card. In the first nine months of 2024 alone, about 200,000 Idram users made QR payments, totaling roughly 4 million transactions (according to Idram’s internal stats). Features like loyalty rewards (Idram’s partnership with IDBank’s Rocket Line credit and Telcell’s BON points system) have further driven adoption. The user experience is mobile-centric: quick in-app transfers by phone number, instant top-ups, and integration with other services (rideshare, utilities, online shopping) make these wallets an everyday tool. EasyPay also offers a digital wallet app, though it’s used primarily for topping up phone accounts and making utility payments via its terminals; its mobile user base is smaller. These local wallet providers emphasize low or no fees for consumers (often subsidized by merchants or billers) and support features like peer-to-peer transfers, mobile airtime reloads, and even virtual cards. Telcell, for instance, lets users create a digital Visa card in-app that can be used for online shopping.

In addition to local wallets, global mobile payment solutions have entered Armenia. Apple Pay and Google Pay were introduced through local banks starting in 2019–2022, and have since gained traction among iPhone and Android users. Apple Pay launched with support from banks like Ameriabank, ACBA, Inecobank, Converse Bank, Evocabank, and others. This means customers of those banks can add their Armenian-issued Visa or MasterCard to the Apple Wallet and tap to pay with their phone or watch. By 2023, Apple PayGoogle Pay were widely accepted at merchants in Yerevan and other cities, wherever contactless POS terminals are available (which is most retail outlets, as Armenian banks rolled out contactless cards and terminals over the last decade). Google Pay is similarly supported – many Armenian banks (e.g. Evocabank, Ameriabank) enabled their cards for Google Wallet in 2022. The adoption of these wallets is growing particularly among urban and younger demographics who value the convenience and security. For instance, Evocabank reported enthusiastic uptake when it launched Apple Pay for its customers in 2022. Besides convenience, these mobile wallets add security (biometric authentication and tokenization) which appeals to users concerned about fraud.

Local digital wallet apps and international mobile pay platforms are complementary in Armenia. It’s common for a consumer to have multiple payment apps on their phone – one might use Idram or Telcell to pay a friend or a local online store, and use Apple Pay with a bank card to tap at a supermarket or gas station. Digital wallets in Armenia have also expanded into public services: for example, transport cards can be reloaded via Telcell, and some parking payments can be done through these apps. The overall trend is a move towards a mobile-first, app-driven payment culture. This is evidenced by the Central Bank reporting double-digit growth in non-cash retail payments year over year, and numerous businesses actively promoting wallet payments (sometimes offering discounts or cashback for QR or app payments). As smartphone penetration increases and more merchants integrate these solutions, Armenia is steadily embracing the convenience of digital wallets. Additionally, the significance of payroll taxes in overall payroll costs cannot be overlooked, and digital payment solutions can help manage these expenses efficiently.

Merchant Accounts in Armenian Banks

Setting up a merchant account in Armenia is a key step for businesses (local or foreign) that want to accept card payments (online or in-store). A merchant account refers to a specialized bank account or service agreement that allows a business to process credit/debit card transactions and receive the funds. In Armenia, merchant accounts are offered by both traditional banks and licensed Payment Service Providers (PSPs). For Armenian-registered businesses (residents), the process to open a merchant account typically involves the following steps:

Choose an Acquiring Bank/PSP: Merchants usually start by selecting a bank or payment company that offers acquiring services. Major Armenian banks like Ameriabank, ACBA Bank, Ardshinbank, Inecobank, AraratBank, Converse Bank, HSBC Armenia, etc., all provide merchant account services (often called “VPOS” for virtual POS for online payments, or POS terminals for offline). PSPs like Idram or Telcell can also onboard merchants under their umbrella.

Provide Documentation: The business must present required documents – proof of company registration in Armenia, tax identification, bank account details, and information about the nature of the business (website, description of goods/services). Banks will perform due diligence (KYC/KYB checks) and also assess the risk of the business (especially for online sales).

Sign Agreement and Setup: Upon approval, the merchant signs an agreement outlining fees, reserve requirements (if any), payout schedule, and compliance obligations. For online payments, the bank/PSP will issue API credentials or a payment gateway link (often via ArCa’s system for local banks). For point-of-sale, they provide card terminals. The merchant account allows acceptance of ArCa, Visa, Mastercard (and sometimes Amex) in AMD.

Integration and Testing: If it’s an online merchant account, the technical integration is done next. For example, Ameriabank’s VPOS or ArCa’s gateway will be integrated into the merchant’s website or app, using provided API keys and following the integration guide (the ArCa integration manual is available – currently in Russian – detailing the process). Test transactions are run to ensure everything works and is secure (3-D Secure, etc.). After successful testing, the bank enables the production mode.

Go Live and Maintenance: The business can now process live transactions. Settlements from the merchant account to the business’s bank account are typically done daily or weekly in AMD. The merchant must comply with any ongoing requirements, such as providing invoices for large transactions if requested (for AML) or renewing the agreement annually.

Requirements for residents vs. non-residents: Local Armenian businesses (with a company registered in Armenia) generally have an easier path – Armenian banks readily provide merchant services to domestic companies, and even foreigners can open bank accounts or companies in Armenia relatively easily. In fact, Armenia allows 100% foreign-owned LLCs and non-residents can open bank accounts, sometimes even remotely. However, to obtain a merchant account as a non-resident business (without Armenian entity) is more challenging. Most Armenian acquiring banks will require you to register a local company or partner with a local PSP. If a foreign business just wants to sell to Armenia, they might use alternative methods (like an international gateway or have an Armenian distributor handle payments). Non-resident individuals (e.g. foreign freelancers) can’t directly get a merchant facility from banks, but they can use services like Payoneer or foreign payment processors to bill clients. The Central Bank of Armenia has encouraged financial inclusion, so the banking sector is relatively open to foreign investors/businesses, but merchant acquiring is still typically tied to having a legal presence in the country for accountability. Additionally, the Armenian Credit Reporting Agency (ACRA), the licensed credit bureau, plays a crucial role in providing essential credit information for businesses, ensuring transparency and reliability in financial transactions.

Banks and non-bank institutions offering merchant services: Virtually all 18 local banks can set up merchant accounts for card acceptance. Notably, Ameriabank is known for a robust internet acquiring service (supporting multi-currency settlements and integration with ArCa and international card systems). Ardshinbank, AraratBank, ACBA and others also connect to the ArCa gateway for e-commerce. Evocabank – a mobile-focused bank – actively courts online merchants and even provides APIs for integration. On the non-bank side, Idram (which is licensed as a Payment and Settlement Organization by the CBA) offers merchant accounts under its e-money system: a business can accept payments from Idram users and receive settlements to their bank. Telcell likewise enables merchants to collect payments via Telcell Wallet or through its network and settle to the merchant’s account. These non-bank PSPs often have simpler onboarding (since they handle smaller merchants frequently) and can onboard sole proprietors. Additionally, international PSPs like 2Checkout function as an external “merchant account” – Armenian companies sign up online and, once approved, 2Checkout processes cards on their behalf and then remits funds to Armenia via wire or to a Payoneer account.

It’s worth noting that Armenia’s merchant account fees are generally competitive for the region. Local banks might charge, for example, 2%–3% per transaction for online card payments (depending on volume and business type) and usually a one-time setup fee. There is often a monthly service fee (or minimum turnover requirement) for maintaining the service. Non-bank providers like Idram may charge merchants a similar fee or slightly lower for wallet payments, since they want to incentivize usage (and they earn from float or other services). Settlement times are quick – local AMD settlements often next business day for banks. Overall, opening a merchant account in Armenia as a local business is a straightforward process, and even foreign entrepreneurs find it relatively easier than in some other countries (Armenia is known for its business-friendly banking policies for newcomers). By securing a merchant account, businesses can tap into the growing base of Armenian cardholders and digital wallet users, essential for e-commerce and cashless sales.

Cross-Border and International Payment Capabilities for Foreign Trade Transactions

Armenian businesses and freelancers frequently need to send or receive cross-border payments – whether it’s an IT firm exporting services or an e-commerce store selling abroad. Armenia’s financial system provides several avenues for international payments, though it has some unique aspects due to its non-membership in certain networks like SEPA. Here’s how cross-border payments work and what capabilities exist:

Receiving International Payments: The traditional route is via SWIFT wire transfers to Armenian bank accounts. Armenia is not part of the EU’s SEPA zone (and it doesn’t use IBAN account numbers natively), so incoming Euro transfers typically must come via SWIFT to the bank’s SWIFT code, with the account number in local format. Major Armenian banks have correspondent accounts in the US, EU, and Russia to facilitate USD, EUR, and RUB transfers. For example, if a US partner wants to pay an Armenian company, they can send a wire in USD to the Armenian bank’s correspondent in New York, which then credits the Armenian account. SWIFT transfers to Armenia usually take 1–3 business days. Fees for incoming wires are modest (often around $10–$20). Armenian banks can hold accounts in multiple currencies – it’s common for businesses to have USD and EUR accounts alongside AMD. This multi-currency support means an Armenian exporter can invoice in USD/EUR and receive funds without immediate conversion. Some banks even allow foreign currency accounts with no conversion until the user decides, helping manage FX risk. Beyond bank wires, services like Wise (TransferWise) and Remitly have started covering Armenia, allowing individuals to send money from abroad which is then deposited as a local transfer (these services use partner banks or the card networks to deliver funds, often with lower fees). Freelancers and IT companies heavily use Payoneer, as mentioned – Payoneer provides virtual receiving accounts in the US/EU, so a cross-border client can simply do a local ACH or SEPA transfer, and Payoneer then makes the funds available in Armenia (with the user withdrawing in AMD). Similarly, clients can pay via credit card to a Payoneer invoice. In absence of direct PayPal receiving, many Armenian freelancers bill clients through Payoneer or even crypto. Cryptocurrency is sometimes used informally for cross-border payments, but more on that in the crypto section. Additionally, companies engaging in international trade can explore other trade finance options to manage financial exchanges effectively.

Sending International Payments: Armenian companies can also send money abroad. All banks offer outgoing SWIFT transfers in foreign currencies. A business in Armenia can pay an international supplier via a wire in USD, EUR, etc., provided they furnish the beneficiary’s SWIFT details. Armenia’s currency, the dram (AMD), is fully convertible, but in practice large transfers are done in USD/EUR. For intra-regional trade (e.g. with Russia or EEU countries), payments in RUB are also common and facilitated by local banks’ correspondent accounts in Moscow. SEPA transfers (euro payments) are handled via SWIFT since Armenia isn’t in SEPA; as such, Euro transfers might incur slightly higher fees or take an extra day compared to intra-EU SEPA. There is interest in possibly joining SEPA in the future, but as of 2025 it’s not yet in place. Apart from bank transfers, Armenian users can send money internationally using systems like Western Union or MoneyGram (for cash remittances), which are widely available. The growing integration with global fintech means some Armenian banks allow transfers via online banking that route through systems like Wise or other APIs for better rates.

Currency Exchange & Multi-Currency Support: Cross-border commerce often involves currency conversion. Armenian payment processors generally settle local transactions in AMD (as required by law for domestic sales), but for international dealings, businesses maintain foreign currency accounts. There are no capital controls on holding foreign currency in Armenia – you can freely convert AMD to USD/EUR and vice versa at market rates. Many online payment solutions support multi-currency: for instance, 2Checkout allows charging customers in their local currency and then converting and paying out to the Armenian merchant (one can hold a balance in USD and then withdraw). Armenian banks themselves sometimes provide merchant accounts in USD or EUR for specific scenarios (though typically local online sales must be priced in AMD by regulation). Currency exchange in Armenia is straightforward, with competitive rates offered by banks and exchange offices, so companies often convert incoming funds as needed or keep a portion in foreign currency to pay expenses. The Central Bank monitors exchange rates but the market is generally free-floating.

Integration with Global Platforms: Armenian payment providers increasingly integrate with global e-commerce platforms to facilitate cross-border trade. For example, some local gateways have plugins for Shopify, WooCommerce, Magento etc., enabling foreign currency payments. However, if those are insufficient, Armenian merchants leverage global platforms that are already integrated with international payments. A local seller might use Etsy, Amazon, or eBay – in such cases, those platforms handle the payment (via their global gateways) and then disburse to the seller (often through Payoneer or bank transfer). There are also initiatives like EU4Digital eCommerce pilot projects to help Armenian SMEs sell across borders, which streamline logistics and payment handling. For B2B transactions, Armenia is part of the SWIFT network and also connected to systems like SWIFT gpi (for faster tracking of international payments), making cross-border business payments more transparent. SWIFT, SEPA, and other networks: While SEPA isn’t directly accessible, some Armenian fintech companies partner with EMI (Electronic Money Institution) providers in Europe to obtain IBANs for Armenian clients (essentially offering virtual EU accounts for local companies). This is not yet mainstream but indicates the direction of travel – bridging Armenia into global payment rails more seamlessly. Additionally, the Eurasian Economic Union (EEU) is working on its own integration; as an EEU member, Armenia could benefit from any regional payment systems that may develop (though currently most use SWIFT).

In summary, international payments in Armenia are quite feasible: SWIFT wires provide the backbone for large B2B transfers, Payoneer and similar fintechs serve freelancers and SMEs, and card networks (Visa/Mastercard) allow Armenian merchants to accept payments from international customers (via gateways like 2Checkout or through ArCa’s connectivity for foreign-issued cards). Armenian banks’ ability to handle multiple currencies and the lack of strict currency controls make cross-border financial transactions relatively smooth. The main limitation has been the partial availability of consumer-facing services like PayPal/Stripe, but workarounds and alternative solutions have largely filled the gap.

Payment Gateway Integration Options

Implementing a payment gateway on websites or mobile apps in Armenia involves various integration options – from ready-made plugins to custom API development. Both local and international gateways offer tools for developers to integrate payment processing into e-commerce platforms, and the ease of setup has improved in recent years.

For popular e-commerce platforms like Shopify, WooCommerce, Magento, OpenCart, etc., Armenian merchants have access to plugins and third-party integration services. For instance, the ArCa payment gateway can be integrated into WooCommerce via a plugin (such as the “Planet Studio ArCa WooCommerce” plugin) which lets merchants accept payments from local and international customers directly to Armenian bank accounts or Idram, through the ArCa PayCenter. There are also Shopify custom apps that enable ArCa or local gateways integration – given that Shopify doesn’t natively list Armenian gateways, local developers have created private integrations. Some local IT companies (or freelancers) specialize in setting up Armenian payment gateways on Shopify and other platforms for a fee. WooCommerce and Magento have dedicated modules for Idram (e.g. ArmMage’s Magento extension for Idram Pay) and for ArCa, which significantly reduces development effort. OpenCart and other systems similarly have extensions published by the community to support Idram or ArCa.

If a business isn’t using a standard CMS or needs a more tailored solution, they can integrate via API. Idram, Telcell, and ArCa each provide API endpoints for payment requests and confirmations. The typical integration involves redirecting the user to a secure payment page or invoking an SDK where the customer enters card or wallet credentials, then receiving a callback to the merchant site. For example, to integrate ArCa’s system, the merchant follows ArCa’s Integration Manual (provided by the Armenian Card company) which outlines how to create payment orders, handle responses, etc. As per ArCa’s guidelines, one must first test in a sandbox mode (ArCa provides test credentials after the initial setup with a bank) and then get production credentials once the flow is verified. Idram’s integration similarly requires contacting Idram for a merchant key and implementing their payment gateway API – Idram and IDBank (its partner bank) refer to this as VPOS integration. A Medium article by a local developer describes integrating AmeriaBank’s VPOS and Idram’s API in a Laravel PHP app, indicating that basic HTTPS requests and form submissions are used to complete payments. Telcell Wallet integration is available via Telcell’s API as well – Ecwid’s documentation actually lists “Telcell Wallet” as a payment method for Armenia, meaning Telcell likely worked with them to provide an integration.

In terms of developer documentation and support, one challenge historically was that some docs were only in Armenian or Russian. As of late 2024, ArCa’s manual is in Russian (though translation is available), and Idram’s documentation may need direct contact. However, the community has filled gaps by sharing example code and libraries. Many Armenian developers are familiar with integrating local gateways, so businesses can hire local devs or agencies if needed. On the other hand, international gateways like 2Checkout, Stripe (if used via a foreign entity), or PayPal SDKs come with extensive English documentation and sample code. For example, 2Checkout/Verifone provides plugins and an API that Armenian merchants can use (2Checkout’s platform can be dropped into a site with minimal coding – just an embed script and some configuration). If a merchant uses Payoneer Checkout (a newer service Payoneer offers for accepting card payments in some regions), that’s another API-driven solution.

Ease of setup: For non-technical users, leveraging an existing plugin is the quickest path. Installing a WooCommerce plugin for ArCa or Idram and entering the merchant credentials can get a store live in hours. Shopify, which lacks native support, might require subscribing to a custom gateway app (like one by Oganro or CartDNA specifically for Armenian gateways). Custom integration via API is more involved but gives full control – one can design a checkout experience and integrate multiple methods (for example, offering both Idram and card payment options side by side). Testing is a crucial part – ensuring that payments are properly confirmed and that fail cases (declines, etc.) are handled. Local providers do offer test environments: e.g., ArCa’s test environment is accessible after initial setup. Developer support from banks/PSPs in Armenia is generally available via email or phone (ArCa provides a contact for merchant support). Given the increasing interest, more documentation is being translated to English and more sample code is shared on platforms like GitHub by Armenian fintech enthusiasts.

To summarize, integrating payment gateways in Armenia is quite achievable: out-of-the-box plugins cover many scenarios and custom APIs enable deeper integrations. Merchants can enable payments on popular platforms with minimal coding, while those with bespoke systems can directly integrate with local banks or international processors. The key is to choose the right combination of gateways to support the desired payment methods (local wallets, cards, etc.) and follow the provided guidelines. With the foundations in place, even smaller Armenian startups have managed to set up online payments that cater to both local and global customers, indicating that integration hurdles are lowering each year. Additionally, requesting advance payment is a prudent strategy for secure transactions, especially when dealing with new business relationships.

Regulatory and Compliance Environment

Armenia’s payment processing industry operates under a well-defined regulatory framework overseen by the Central Bank of Armenia (CBA) and shaped by laws aimed at ensuring financial stability, security, and consumer protection. As digital payments grow, regulators have updated rules to keep pace with technology (including forthcoming crypto regulations). Key aspects of the regulatory and compliance environment include:

Central Bank Oversight and Licensing: The CBA is the chief regulator for banks and financial institutions, including Payment Service Providers (PSPs) and e-money issuers. Any company providing payment processing services in Armenia must be licensed by the CBA under the relevant category. For example, Idram and Telcell each hold licenses as payment and settlement organizations/electronic money issuers, granted by the CBA. Idram was first licensed in 2009 for money transfers and in 2012 received special permission to issue electronic money (making it a pioneer in e-wallet licensing). This means the CBA requires these companies to meet capital requirements, safeguard customer funds, and submit to audits. Similarly, Armenian Card (ArCa) is itself regulated by the CBA (it’s collectively owned by the banks and operates critical payment infrastructure under CBA oversight). Merchant acquiring banks of course are licensed banks under CBA supervision. The CBA uses tools like its regulatory sandbox to allow fintech innovations to be tested under lighter regulations before formal adoption – this sandbox has attracted significant fintech projects and investment. Additionally, there is one licensed credit bureau in Armenia, the Armenian Credit Reporting Agency (ACRA), which plays a crucial role in the financial landscape. Overall, any payment processor or PSP in Armenia needs appropriate licensing, ensuring that the market isn’t a free-for-all – entrants must demonstrate security and reliability.

AML/CFT Compliance: Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) rules in Armenia are strict and aligned with FATF standards. Payment processors, like banks, are considered “reporting entities” under AML law. They must perform KYC (Know Your Customer) verification on their users/merchants. For instance, when a user registers an Idram or Telcell wallet above a certain balance or transaction volume, they are required to verify their identity (usually by providing an ID and sometimes visiting an agent or using digital ID). Large transactions are monitored – e.g., any transfer above a threshold (say AMD 20 million, approx $50k) might be reported to the financial monitoring center. For merchants, banks will ensure the business is legitimate and not on any sanctions lists. Armenia has in recent years tightened AML enforcement, partly due to increased international flows. As a result, PSPs apply transaction monitoring – unusual patterns can trigger account reviews. This is important for international payments; as one Reddit discussion noted, PayPal hasn’t fully opened in Armenia partly because of needing certain AML regimes in place (though Armenia has made progress on that front). Now with more business going cashless and all salaries/incomes declared from 2024, transparency is improving. In summary, any payment solution operating in Armenia must implement customer verification, record-keeping, and suspicious activity reporting in line with AML laws.

Consumer Protection and Security: The regulatory environment emphasizes protecting end-users in payment transactions. The CBA mandates that payment providers ensure secure transaction processing – for example, PCI DSS compliance for card data (ArCa and banks adhere to PCI Data Security Standards), and 3-D Secure authentication for online card payments to reduce fraud. If a consumer faces unauthorized charges, Armenian law and card network rules allow dispute resolution (chargebacks). The CBA also requires transparency in fees – PSPs must disclose commissions clearly. In recent years, the government has pushed measures to increase trust, such as requiring receipts for all transactions (even digital) to curb the shadow economy. The Law on Consumer Lending and related acts cover some aspects of payments (like refund timelines if a payment is reversed). Furthermore, the CBA runs public awareness campaigns on digital financial literacy, informing people of their rights and how to use new payment tools safely.

Role of ArCa and National Policies: Being the national payment system, ArCa plays a compliance role too. All local card transactions often route through ArCa’s switch, which means they stay within a controlled environment. The Armenian government in 2022–2023 implemented laws to reduce cash usage, as discussed, not only for economic reasons but to improve tax compliance and reduce illicit transactions. There’s also a push towards Open Banking and digitization: Armenia is developing a unified digital ID system and working on open data frameworks, which in the future will enable licensed third-party providers to access banking data or payments (inspired by EU PSD2). This could spur new payment initiation services or fintech apps that connect to bank accounts, under CBA regulation.

Taxation of Online and Cross-Border Payments: From a tax perspective, Armenia imposes VAT (Value Added Tax) on electronic services. The VAT rate is 20% for most goods and services, including digital services consumed in Armenia. In late 2023, the Eurasian Economic Commission (which Armenia is part of) approved new rules requiring foreign providers of electronic services (like global SaaS or streaming companies) to register and pay VAT on sales to consumers in Armenia. This is similar to the EU’s approach and is set to be implemented by January 2025. Practically, this means if an Armenian consumer buys, say, online software from a foreign company, that company should charge Armenian VAT and remit it. For local online merchants, the standard tax rules apply – if you’re an Armenian entity, you pay VAT on your sales in Armenia (or turnover tax for small businesses) regardless of payment method. Income from abroad (for example, an IT export paid via bank transfer or Payoneer) is generally subject to Armenian profit tax or income tax, but the government has offered IT sector tax incentives (like reduced profit tax and income tax) to boost exports. As mentioned, starting in 2024 all Armenian residents must file annual income declarations, which means even freelancers receiving money via Payoneer or crypto are required to declare that income for taxation. On the flip side, double taxation treaties can apply – Armenia has treaties with many countries, so cross-border payments like dividends, royalties, etc., may have reduced withholding tax. Payment providers facilitate tax compliance by providing statements of transactions. The CBA and tax authorities also collaborate to ensure that large flows (like >AMD 3 million transactions flagged by the cashless law) are documented.

In essence, the regulatory environment in Armenia is balancing innovation with control: encouraging digital payments and new fintech (via sandbox and modern laws) while enforcing compliance (licensing, AML, reporting) to maintain trust and financial integrity. The Central Bank’s approach has been technology-neutral regulation – as one official noted, they aim for equal regulation for all technologies so that whether a payment is via a bank card or a fintech app, it meets the same standards. This creates a level playing field and protects users, fostering a healthy ecosystem for payment processing solutions to thrive in Armenia.

Cryptocurrency Payments in Armenia

Cryptocurrencies have a growing presence in Armenia’s financial discourse, even if they are not yet mainstream for everyday payments. The legal status of crypto in Armenia has been something of a gray area until recently. For years, Armenia had no specific laws regulating crypto assets – owning, buying, or selling crypto was not prohibited, but it wasn’t formally recognized either. This lack of regulation provided freedom for enthusiasts to trade and mine crypto, but also meant no legal framework for businesses to accept crypto as payment.

As of 2024–2025, this is changing. The Armenian government approved the country’s first dedicated law on cryptocurrency in early 2025, signaling a shift towards a regulated crypto market. This new law on “Crypto-Assets” (passed in late 2024 and confirmed in Feb 2025) introduces licensing for companies providing crypto services and sets rules to address sector risks. The Central Bank’s Deputy Chairman stated that the goal is to balance innovation with user protection, following the model of the EU’s MiCA (Markets in Crypto-Assets) regulation. Under the upcoming framework, exchanges and crypto brokerages will need to obtain a license to operate in Armenia, ensuring they implement AML checks and consumer safeguards. Interestingly, certain things are excluded from regulation: the CBA indicated CBDCs, NFTs, and non-convertible tokens (like strictly utility tokens) won’t fall under this law. But typical cryptocurrencies (Bitcoin, Ethereum, etc.) and related services (trading, custody, payment processing) will be regulated and companies offering them will be supervised. This means that in the near future, we may see licensed crypto exchanges in Armenia and possibly crypto payment processors that comply with local law.

The Central Bank’s stance on crypto has evolved from caution to cautious engagement. In the late 2010s, the government wasn’t keen on promoting crypto usage as legal tender (they even dismissed a proposal to exempt crypto mining from taxes in 2018). Banks in Armenia have historically been unwelcoming to crypto – many would freeze or scrutinize transfers related to crypto exchanges, and crypto-related businesses struggled to get banking services. This stemmed from AML concerns and the lack of regulation. However, with substantial investments coming into Armenian crypto mining (the country has had large mining farms due to relatively cheap electricity in some regions) and a growing IT sector, authorities recognized the need for a legal framework. By October 2024, reports indicated the CBA even authorized Armenian banks to conduct certain crypto transactions (perhaps pilot projects), showing a softening stance. The new law in 2025 is the culmination of this work, suggesting that Armenia is open to crypto innovation but within a regulated environment. A Central Bank official noted they prefer the term “crypto-assets” and want to ensure equal regulation no matter the technology – implying that once regulated, crypto transactions will be held to similar standards as traditional finance. This also means that financial obligations, such as severance pay, will need to be considered in the evolving financial landscape, ensuring that employee compensation aligns with new digital asset regulations.

In practical terms, can you pay using crypto in Armenia? Currently, crypto is not an officially accepted payment method for goods and services – Armenian law says transactions in Armenia should be in dram. That said, it’s not illegal for two parties to settle a private deal in crypto; it’s just not protected by law in the same way. In reality, very few businesses accept cryptocurrency directly. A local guide in 2023 noted that only extremely rare cafes or hotels might agree to take crypto, and typically only if an owner personally is willing to accept a transfer to their wallet. The safer approach often used is to convert crypto to fiat: e.g., using an exchange or crypto ATM (cryptomat) to turn Bitcoin into cash/AMD which is then spent. Indeed, Armenia has installed some crypto ATMs in Yerevan: as of 2023, there are machines at locations like Yerevan Mall, Ani Plaza Hotel, Zvartnots Airport, etc., where one can buy or sell crypto for cash. These cryptomats (such as the SkyLabs SkyCrypto terminals) allow users to trade BTC, ETH, USDT and more for Armenian dram. The presence of these ATMs indicates there is demand for on-the-ground crypto exchange. Additionally, several online crypto exchanges serve Armenian users. Many Armenians use international platforms like Binance, Kraken, Coinbase for trading. Binance is particularly popular in the region due to its wide range of services and the ability to P2P trade (Armenian dram is supported in Binance’s peer-to-peer marketplace as a currency). A number of blockchain startups also hail from Armenia – for instance, CoinStats (a crypto portfolio app) is an Armenian company, and there’s a growing blockchain developer community. These factors contribute to crypto awareness, even if day-to-day retail crypto payments are rare.

Legal status and Central Bank stance on crypto: Until the new law is fully implemented, crypto isn’t legal tender but owning and transacting crypto is allowed at one’s own risk. The tax authority currently views crypto-to-fiat gains as investment income (subject to capital gains tax if realized). Mining income was not taxed under a temporary proposal until 2023 (though that proposal wasn’t officially adopted fully). With regulation, we can expect clearer rules – possibly exchanges will have to report large transactions, and users may be taxed on crypto holdings conversions. The Central Bank has also floated the idea of a CBDC (digital dram), though that is in exploratory stages. If launched, a CBDC would be state-controlled and separate from cryptocurrencies, but it shows the CBA’s interest in digital asset innovation.

Popular crypto platforms in Armenia: As mentioned, Binance likely has the largest user base (it’s accessible and offers an Armenian language option). Coinbase can be used to a degree (Armenians can create accounts, but linking local banks/cards to buy crypto is not straightforward; many instead use a US or EU bank account or card if they have one). OKX, Bybit, and Kraken are also used by the crypto-savvy. There’s at least one local exchange service (such as “Crypto Exchange Armenia” OTC shop in Yerevan), where people can physically exchange cash for crypto. Local businesses accepting crypto: While not common, a few tech-forward companies do. For example, some IT service providers or freelancers might accept payment in USDT or BTC from foreign clients to avoid transfer fees, then possibly keep it as an investment or cash out through an exchange. There was news of a few shops experimenting with crypto payments using BitPay or similar crypto merchant tools, but this isn’t widespread. As the legal framework comes in, we might see more real-life examples: perhaps electronics stores or online retailers integrating crypto payment gateways like Plisio or CoinPayments. So, while today you won’t typically buy your groceries or pay utility bills in Bitcoin in Armenia, the foundation is being laid for crypto to become a legitimate part of the payment landscape, especially for online commerce and tech services.

In summary, cryptocurrency in Armenia is transitioning from an underground hobby to a recognized sector. The Central Bank in 2024 explicitly stated it will license crypto service providers to ensure a fair and safe market. This will likely spur local startups to launch compliant exchanges and encourage international crypto companies to include Armenia in their coverage. For now, crypto payments remain a niche – used in specific circles and mostly for investment or cross-border transfer convenience – but with the new regulations and growing crypto literacy, we can expect more integration of crypto into Armenia’s financial ecosystem in the coming years.

Challenges and Opportunities

The Armenian payment processing landscape in 2024–2025 faces several challenges, yet these challenges also give rise to significant opportunities for improvement and innovation:

Challenge: Cash Culture and Financial Inclusion – Armenia has been traditionally cash-heavy, and as noted, a large portion of the population still relies on cash for daily transactions. Many Armenians have yet to fully trust or adopt digital payments (only ~40% made a digital payment last year). This can be due to habit, lack of awareness, or limited access to digital infrastructure in rural areas. Financial inclusion is an issue; a segment of the population doesn’t have bank accounts or smartphones, limiting their access to modern payment solutions. However, this scenario is improving as government and private sector push education and infrastructure. Opportunity: The untapped user base means there is room for growth. Fintech startups can develop user-friendly interfaces in Armenian, financial literacy programs, or offline-online hybrid solutions (like payment kiosks bridging cash to digital) to onboard the remaining population. Additionally, as more people get comfortable with smartphones, they can leapfrog directly to mobile wallets even if they skipped card usage initially. Requesting advance payment for goods and services can also mitigate risks in international transactions until trust is developed between parties.

Challenge: Limited Global Player Presence – The absence or limited functionality of big international payment players (Stripe, PayPal) in Armenia has been a hurdle for businesses aiming for international reach. It forces workarounds that can be costly or complex. Opportunity: This gap has allowed local fintech companies to flourish by providing tailored solutions. Entrepreneurs can build services that aggregate multiple international methods and offer them under one platform to Armenian users. For example, a startup could create a unified checkout that lets Armenian merchants accept card payments, plus alternative methods (crypto, etc.), thereby filling the void left by Stripe. Also, lobbying and continued regulatory alignment could eventually encourage those big players to enter the market – which would validate the market’s growth.

Challenge: Integration and Technical Barriers – While integration options exist, some merchants find it technically challenging to integrate local payment gateways, especially with documentation not always in English. Smaller businesses without IT teams may be intimidated by setting up online payments. Opportunity: There’s room for fintech-as-a-service and developer tools. We might see more plug-and-play solutions, or third-party services that handle the entire payment setup for a merchant (for a small fee), thus reducing the tech barrier. Also, as the community grows, open-source plugins and clearer multilingual documentation are likely to appear (we already see moves in this direction). This creates opportunities for local developers to productize their integration expertise.

Challenge: Market Size and Competition – Armenia is a relatively small market (~3 million people). This can limit economies of scale for payment processors and result in higher per-transaction costs or slower ROI on new technology deployments. Additionally, some segments (like payment terminals) are dominated by a couple of players, which might stifle competition. Opportunity: Despite the size, Armenia’s market can serve as a testbed for innovation. Its young, educated tech workforce and supportive regulators mean new solutions can be developed and tried in Armenia, then potentially exported to larger markets or to the Armenian diaspora abroad. Also, the growing e-commerce and IT export sector in Armenia punches above its weight – meaning even a small population generates a lot of payment volume in certain niches (IT services, online commerce, remittances). Startups can focus on these high-value niches. Being a small market also means agility – changes (like the shift to contactless or implementation of a new law) roll out nationwide quickly, allowing companies that respond fast to capture the market.

Challenge: Economic and Geopolitical Factors – Armenia’s region has its complexities (e.g., conflicts can disrupt economic activity or affect correspondent banking relationships). For instance, banks have to be careful with sanctions (due to closeness with Russia/Iran). Currency fluctuations of the dram against USD/EUR could impact costs for payment providers and merchants. Opportunity: Armenia’s strategic position also means it’s a bridge between different economies (Eurasian Union and Western markets). Fintech companies can position Armenia as a regional fintech hub, attracting neighboring countries’ businesses to use Armenian-registered services to circumvent their own local limitations. In fact, the influx of migrants and businesses (like many Russian tech professionals moving to Armenia in 2022) boosted the demand for digital payments and opened opportunities to serve new customer segments. The strong performance of Armenian banks (posting record profits due to that influx) gives them capital to invest in new payment technologies and partnerships.

Challenge: User Trust and Security – As with any digital finance expansion, there are concerns about fraud, cybersecurity, and user trust. Some people fear card scams or losing money online, which slows adoption. Opportunity: Building robust security (biometrics, 2FA, real-time fraud monitoring powered by AI) and communicating these measures can give providers a competitive edge. Companies that establish a reputation for rock-solid security and customer protection will earn user trust and loyalty. Moreover, Armenia’s push for digital ID can simplify secure onboarding, turning a challenge (KYC friction) into an opportunity (e.g., instant eKYC via government e-ID for opening wallets or accounts).

Opportunity: Innovation in Services – With the basic payment infrastructure being set, the next opportunity is layering value-added services. Buy Now, Pay Later (BNPL) is already emerging (Telcell’s PartPay offers installment payments). Open banking could allow new apps that aggregate accounts or enable one-click payments from bank to merchant without cards. Remittance-linked services could allow diaspora to pay bills for family back home directly through utilities’ online systems. Cryptocurrency integration offers a forward-looking area – e.g., platforms that automatically convert incoming crypto to AMD could let businesses accept crypto without volatility risk. As the law allows, crypto payment processors like Plisio (already suggested by Ecwid) can be more openly used, giving merchants a new customer base (crypto holders).

Opportunity: Government and B2B Payments – The government’s digitization (such as e-gov portals for paying taxes, fines, etc.) ensures a large volume of payments going digital. Companies that facilitate B2B payments (which are often still done by paper or manual bank transfers) could find fertile ground. For example, an online invoicing platform that integrates local payment options could thrive as businesses modernize their accounts receivable processes.

In conclusion, Armenia’s payment processing scene in 2024–2025 is at an inflection point. Challenges like entrenched cash habits, small market size, and partial global integration are being actively addressed through technological innovation, progressive regulation, and the entrepreneurial drive of Armenian fintech firms. The result is a landscape where opportunities abound – for local startups to become regional players, for global companies to enter a reforming market, and for consumers and businesses to benefit from a more connected, efficient payment ecosystem. The next few years will likely see Armenia consolidating its gains (higher cashless adoption rates, more competition among providers) and possibly leaping ahead with new technologies, solidifying its reputation as a growing fintech hub in the Caucasus.