Investment Highlights in Armenia’s Wine and Beverage Sector

Armenia, a land steeped in ancient history and boasting a rich cultural heritage, is rapidly emerging as an appealing destination for strategic investments within its burgeoning wine and beverage industry. With winemaking traditions stretching back over six millennia, Armenia offers a unique blend of historical significance and modern economic potential. This report delves into the key factors that make Armenia an increasingly attractive prospect for potential investors, international business owners, and industry stakeholders. The country’s claim as the cradle of viticulture provides a powerful and authentic selling proposition, resonating with a global market increasingly seeking heritage and quality. Furthermore, Armenia’s favorable climate and diverse terroir offer ideal conditions for cultivating a wide array of grape varieties, many of which are indigenous and contribute to the unique character of Armenian wines. Beyond wine, the beverage sector is experiencing diversification and growth, presenting a broader spectrum of investment opportunities. A rising domestic and international demand for Armenian beverages, coupled with proactive governmental support and incentives, further enhances the investment appeal. Competitive advantages such as unique grape varietals, strategic geographic location, and a skilled workforce contribute to a compelling investment narrative.

Armenia: Cradle of Viticulture and Beverage Production – A Historical Perspective

Armenia’s legacy as a pivotal region in the history of winemaking is not merely anecdotal; it is substantiated by compelling archaeological evidence. The discovery of the Areni-1 winery, dating back to an astonishing 4100 BC, firmly establishes Armenia as the location of the world’s oldest known wine production facility. This remarkable finding, unearthed in a cave complex near the village of Areni, included a wine press, fermentation vats, storage jars, and even remnants of grape seeds, providing irrefutable proof of sophisticated winemaking practices in the region over six millennia ago. Further archaeological investigations across the Armenian Highlands have indicated wine production as early as 6000 BC, underscoring the deep historical roots of viticulture in this land .

Beyond archaeological findings, written records also attest to Armenia’s ancient winemaking prowess. In the 4th century BC, the Greek historian Xenophon documented his armies being treated to wine and beer during their passage through Armenian lands . These beverages were reportedly stored in “karases,” traditional clay pots that continue to be used by some Armenian winemakers today . Excavations in the area of modern-day Yerevan have revealed that it was a significant winemaking center as early as the 9th century BC, with the Teishebaini fortress alone containing storage for hundreds of “karases”. Wine presses dating from the 3rd to 1st century BCE discovered near ancient Armenian capitals further solidify this historical narrative .

The cultural significance of wine in Armenia extends beyond mere sustenance. Legend has it that Noah, upon landing his ark on Mount Ararat, planted the first vine on its slopes, establishing a divine connection to winemaking . Throughout history, wine has been deeply intertwined with Armenian culture and religious practices . It holds a sacred place in ceremonies such as Baptism and Matrimony, and the Armenian Church maintains the tradition of grape blessing . Grapes and wine are potent symbols in Armenian culture, representing the blood of Christ and embodying themes of eternity and rebirth, frequently adorning cross-stones and church walls .

While wine holds a prominent place, the production of other beverages also has ancient roots in Armenia. Xenophon’s accounts mention “barley wine,” indicating early beer brewing traditions . This historical context reveals a long-standing tradition of beverage production in Armenia, setting the stage for its modern-day resurgence. The unbroken chain of winemaking knowledge and the deep cultural value associated with it provide a unique foundation for attracting investors who appreciate heritage and authenticity.

Current Landscape: Production Capacity and Diversity of Armenian Wines and Beverages

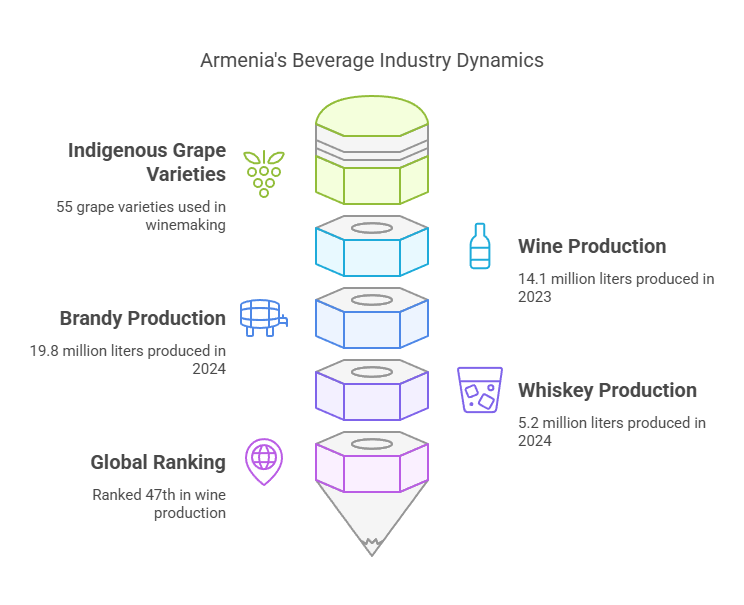

Armenia’s wine and beverage industry has witnessed a significant revival in recent years, building upon its ancient foundations. As of 2023-2024, the country boasts a substantial production capacity across a diverse range of beverages. The total vineyard surface area in Armenia spans 15,574 hectares, cultivated with over 400 indigenous grape varieties, of which 55 are utilized in winemaking . This rich genetic diversity allows for the production of a wide spectrum of wines with unique characteristics.

In 2022, total wine production reached 12.6 million liters, with red wine constituting 65% of this volume . The total grape production amounted to 226,000 tons, supported by approximately 150 wine producers across the country . Data from 2023 indicates a further increase in grape wine production, reaching 14,124.7 thousand liters . However, other sources provide slightly different figures, with one reporting 9,600 metric tons and another indicating over 10 million liters . These variations may stem from different reporting methodologies or periods. Armenia’s global ranking in wine production was 47th, with an output of 127 thousand tonnes .

Beyond wine, Armenia has a robust production of other alcoholic beverages. Brandy production in 2023 stood at 19,342.7 thousand liters and saw a modest increase of 2.5% in 2024, reaching 19.8 million liters. Beer production in 2023 was 28,243.2 thousand liters , with a further 3% growth in 2024 to 29.1 million liters . In contrast, vodka production in 2023 was 1,627.2 thousand liters but experienced an 18.3% decline in 2024, totaling 1.3 million liters . Sparkling wine production in 2023 was 1,601.4 thousand liters and decreased by 8.7% in 2024 to 1.5 million liters.

The non-alcoholic beverage sector also contributes significantly to Armenia’s beverage industry. In 2023, mineral water production reached 50,941.3 thousand liters, while alcohol-free beverages totaled 153,397.9 thousand liters . Natural juice production amounted to 17,648.6 thousand liters in the same year .

Overall, while manufacturing production in Armenia saw a 6.5% increase in 2024, the beverage production sector experienced a 3.9% decline, accounting for 10.2% of the total manufacturing output . This decrease was partly driven by a significant 29% drop in wine production in 2024 to just over 10 million liters. However, whiskey production witnessed a remarkable sixfold increase in 2024, reaching 5.2 million liters. The total volume of the Armenia beverages market, encompassing hot drinks, soft drinks, dairy and soy drinks, and alcoholic drinks, was 356.2 million liters in the third quarter of 2024 .

| Beverage | 2022 (thousand liters) | 2023 (thousand liters) | 2024 (million liters) |

|---|---|---|---|

| Grape Wine | 12,600 | 14,124.7 | 10.0+ |

| Brandy | – | 19,342.7 | 19.8 |

| Beer | – | 28,243.2 | 29.1 |

| Vodka | – | 1,627.2 | 1.3 |

| Sparkling Wine | – | 1,601.4 | 1.5 |

| Mineral Water | – | 50,941.3 | – |

| Alcohol-free | – | 153,397.9 | – |

| Natural Juices | – | 17,648.6 | – |

| Whiskey | – | – | 5.2 |

The data illustrates a dynamic beverage industry in Armenia, with established sectors like wine, brandy, and beer alongside emerging areas such as whiskey. The availability of numerous indigenous grape varieties presents a unique opportunity for innovation and the creation of distinctive wine products that can capture global market attention.

Market Analysis: Growth Trends and Consumer Demand in Armenia’s Beverage Market

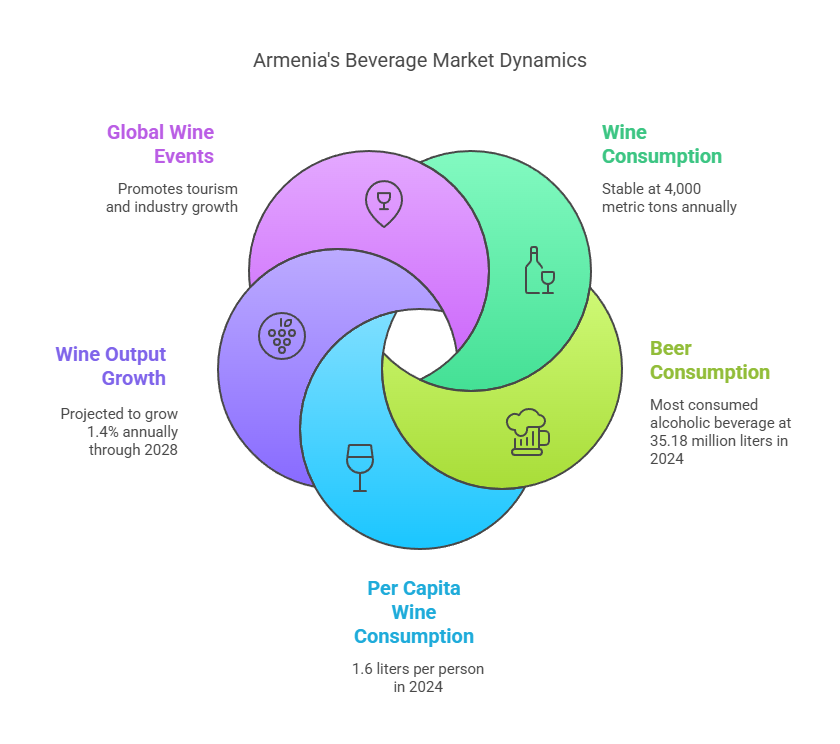

The Armenian beverage market presents a landscape of both stability and emerging trends as of 2024-2025. While Armenian wine consumption is projected to remain relatively stable at around 4,000 metric tons through 2028, maintaining its 2023 level, the market dynamics suggest potential for growth in specific segments . In 2023, Armenia ranked 84th globally in wine consumption . However, wine output is forecasted to see a modest average annual growth of 1.4%, increasing from approximately 9,600 metric tons in 2023 to 10,500 metric tons by 2028. This indicates a focus on production for export and potentially a shift towards higher-value products.

The broader Armenia beverages market, encompassing all categories, reached a consumption volume of 356.2 million liters in the third quarter of 2024 . Notably, hot drinks held the largest share of this market, followed by other segments including alcoholic beverages, where beer was the leading sub-category . Domestic alcohol consumption figures for 2024 reveal a total of 44.8 million liters, with beer accounting for the largest portion at 35.18 million liters, followed by wine at 6.96 million liters, vodka at 1.99 million liters, and brandy at 0.72 million liters.

The overall consumer goods market in Armenia is experiencing growth, estimated at USD 1.64 billion in 2024 and projected to reach USD 2.25 billion by 2031, demonstrating a compound annual growth rate of 4.6% . Another estimate places the market at USD 1,615 million in 2024, with a projected expansion to USD 2,184.86 million by 2032 . The food and beverages segment is expected to be a significant driver of this growth, anticipated to contribute 55.0% of the consumer goods market share in 2025 . The carbonated soft drinks market alone is forecast to reach USD 92.53 million by 2024 .

Consumer spending on food and non-alcoholic beverages saw a 2% increase in 2024, while alcoholic beverages and cigarettes experienced a 3.8% rise . The per capita consumption of wine in Armenia is estimated at 1.6 liters . These figures, combined with an estimated economic growth of 6% in 2024 and a projected 5% in 2025 , suggest a positive, albeit moderating, economic environment that can support the continued growth of the beverage market.

Armenia is also actively promoting wine culture and tourism, as evidenced by hosting the UNWTO Global Conference on Wine Tourism in autumn 2024 and the annual Yerevan Wine Days in May. These initiatives are likely to further stimulate both domestic and international interest in Armenian wines and beverages. While the projected volume of wine consumption remains stable, the increasing value of wine exports indicates a potential shift towards premiumization within the Armenian wine market. This trend suggests that producers are successfully targeting higher-value segments internationally, presenting opportunities for investors focused on quality wine production. The significant domestic consumption of beer compared to other alcoholic beverages points to a robust local market for beer producers. Furthermore, Armenia’s growing focus on wine tourism, with international conferences and local festivals, creates opportunities for investments in hospitality and infrastructure that cater to wine enthusiasts.

Export Potential: Opportunities and Performance of Armenian Wines and Beverages in International Markets

Armenia’s wine and beverage industry is increasingly focused on expanding its presence in international markets, demonstrating a promising export potential. In 2022, 37% of the wine produced in Armenia was exported, indicating a significant outward orientation . The first half of 2024 saw a 3.6% increase in Armenian wine exports, reaching a volume of 2.1 million liters, with the customs value rising by an impressive 10.1% to USD 8.3 million . This disparity between volume and value growth suggests that Armenian wines are commanding higher prices in the international market, indicative of increasing recognition for their quality.

The Russian market remains the dominant destination for Armenian wine exports, accounting for 82.7% of the total in the first half of 2024, although this share has slightly decreased from 85.5% in the previous year . However, other markets are gaining importance. The United States has emerged as a significant growth market, increasing its share from 4.2% to 8.5% during the same period . Key European export markets include France (1%), Poland (0.9%), and Belgium (0.8%) . Notably, the geographical reach of Armenian wine exports has expanded considerably, from 15 countries in 2016 to 39 countries by 2024 .

In 2022, Armenia’s total wine exports amounted to USD 17.6 million, positioning it as the 48th largest wine exporter globally . The primary export destinations by value were Russia (USD 12.8 million) and the United States (USD 2.06 million) . The most significant growth in export markets between 2021 and 2022 was observed in Russia (USD 7.4 million), Israel (USD 125k), and India (USD 88.6k) .

The Vine and Wine Foundation of Armenia (VWFA) plays a crucial role in promoting Armenian wines on the global stage. The foundation actively participates in major international wine events such as Wine Paris and FOODEX JAPAN, organizing tastings and showcasing the country’s winemaking heritage. The Armenian Economy Minister has also emphasized the successful competition of Armenian wine in global markets, highlighting their quality standards .

Historically, challenges such as low product quality and insufficient government support hindered wine exports . However, the current focus on quality improvement and proactive promotional efforts are contributing to a positive shift in export performance.

The heavy reliance on the Russian market for wine exports presents both an advantage and a potential vulnerability. While Russia remains the largest importer, the increasing presence in other markets like the US and Europe indicates a positive trend towards diversification, which is crucial for long-term stability. The fact that the value of wine exports is growing at a faster rate than the volume suggests that Armenian producers are successfully entering higher-value segments in international markets. The active support of the VWFA in international promotion provides valuable assistance for both established and new entrants in the market.

Top Export Destinations for Armenian wine (based on available data from the first half of 2024):

| Country | Volume (million liters) | Value (million USD) | Share of Total Volume (%) | Share of Total Value (%) |

|---|---|---|---|---|

| Russia | 1.74 | 6.84 | 82.7 | 82.41 |

| United States | 0.18 | 0.70 | 8.5 | 8.43 |

| France | 0.02 | 0.08 | ~1.0 | ~0.96 |

| Poland | 0.019 | 0.079 | 0.9 | 0.95 |

| Belgium | 0.017 | 0.066 | 0.8 | 0.80 |

| Other | – | – | – | – |

| Total | 2.1 | 8.3 | 100.0 | 100.0 |

This data underscores the dominance of the Russian market while highlighting the growing importance of the United States and select European countries as export destinations for Armenian wine.

Government Support and Incentives for Wine and Beverage Industry Investments

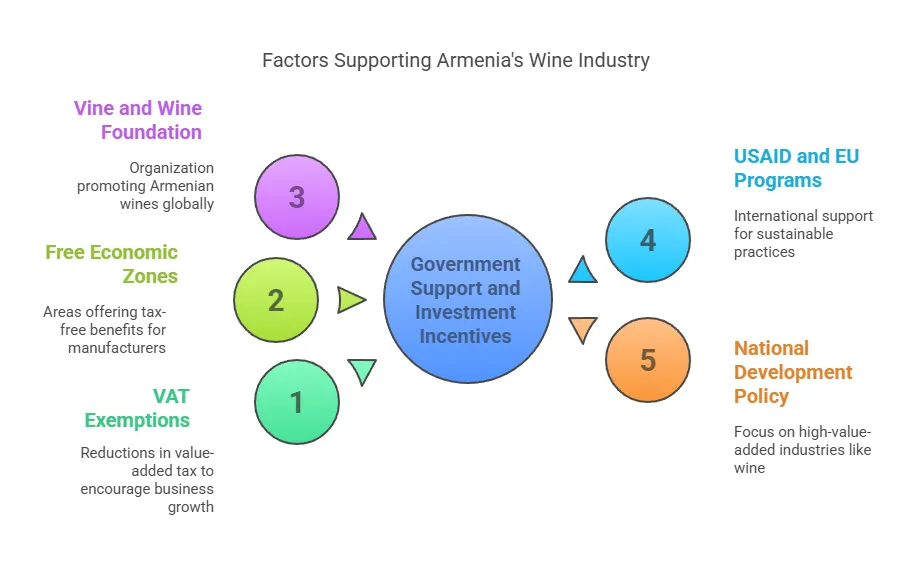

The Armenian government has recognized the significant potential of the wine and beverage industry and has implemented a range of programs and incentives to foster its growth and attract both local and foreign investment . These initiatives encompass financial support, tax benefits, and strategic policy frameworks designed to create a favorable business environment.

A key aspect of governmental support is the provision of tax incentives. The government has established a streamlined taxation system for agribusinesses, including a three-year VAT exemption on imported industrial equipment, an exemption from social security payments, and reductions in profit tax for exporters . Furthermore, firms investing in the manufacturing sector, particularly those with an export focus, benefit from VAT exemptions and simplified procedures for importing machinery and equipment .

To further incentivize investment, the Armenian government has created Free Economic Zones (FEZs) where businesses operating within these zones are exempt from profit tax, VAT, income tax, and property tax . These FEZs are strategically aimed at attracting foreign direct investment and advanced technologies, thereby supporting export-oriented growth in sectors like the wine and beverage industry.

The Industrial Policy Strategy adopted in 2011 underscores the government’s commitment to attracting transnational corporations, supporting innovation, providing financial support for investment and export promotion, building capacity, promoting sales, and improving the legal framework for foreign economic activity . This comprehensive strategy signals a long-term vision for the development of key industries, including the beverage sector.

Specific support for the wine industry is evident through the development of a dedicated strategy for wine production and the prioritization of high-value-added processing industries, such as wine production, in the national 2014-2025 development policy . The Armenian government also actively promotes the “Armenian wines” brand on the international stage . Wineries like Armenia Wine and Golden Grape Armas have received direct government assistance, including VAT payment deferments, demonstrating a tangible commitment to the sector’s growth .

Beyond direct governmental support, international organizations also play a role. USAID has been instrumental in supporting Armenia’s winemaking sector by enhancing production quality, expanding export opportunities, and promoting sustainable agricultural practices . The EU-funded EU4Environment Programme also contributes by supporting green transformation initiatives, which can benefit the beverage industry through resource efficiency and cleaner production methods . Additionally, the government has provided subsidies for agricultural leasing, making it more accessible for farmers and businesses to acquire necessary machinery and equipment .

The establishment of the Vine and Wine Foundation of Armenia (VWFA) in 2016 by the government further highlights the strategic importance of the wine sector. The VWFA is dedicated to the effective and systematic development of the industry, implementing new state policy strategies and development programs aimed at increasing the volume of consumption and export of Armenian wines and enhancing the global recognition of the “Wine of Armenia” brand .

This comprehensive suite of government support and incentives creates a compelling environment for investors looking to capitalize on the growing potential of Armenia’s wine and beverage industry. The focus on export-oriented growth, coupled with tax advantages and strategic policy initiatives, makes Armenia an increasingly attractive investment destination.

Competitive Advantages: Unique Factors Attracting Investors to Armenia

Armenia offers a distinct set of competitive advantages that make it an appealing destination for investment in the wine and beverage sector. These advantages stem from its unique natural resources, historical legacy, and evolving industry dynamics.

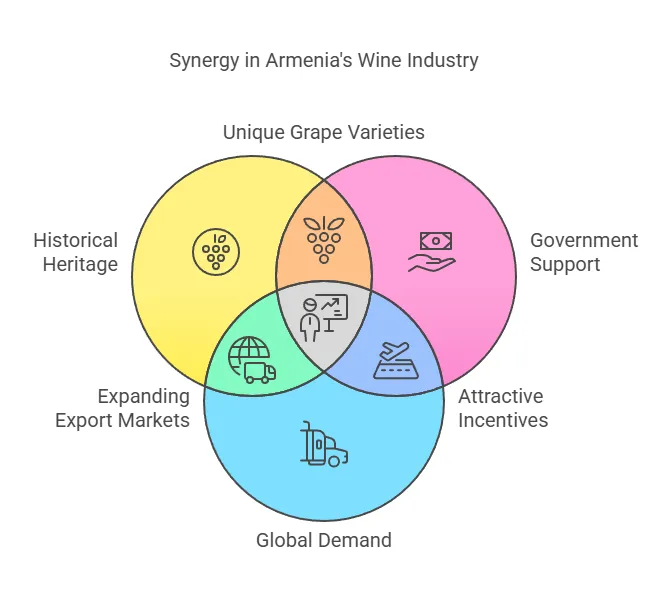

One of the most significant advantages is the presence of over 400 indigenous grape varieties, with 55 currently used in winemaking . Notable varieties such as Areni, Voskehat, and Sirena are endemic to the region and produce wines with unique flavor profiles that are gaining international recognition . This rich biodiversity provides a foundation for producing distinctive wines that can differentiate Armenia in the global market.

Armenia’s terroir, characterized by its volcanic soil, high altitudes, and continental climate with hot summers and cold winters, is ideally suited for grape cultivation . This unique combination of soil and climate contributes to the exceptional quality and character of Armenian wines . Furthermore, many of Armenia’s vineyards boast venerable vines aged 35 years and older, grown on their own roots due to the absence of the phylloxera blight, a significant advantage that contributes to the complexity and resilience of the wines .

The long-standing winemaking tradition, dating back millennia, provides a strong historical narrative that resonates with consumers and investors alike . Armenia’s claim as the “cradle of wine” offers a powerful marketing angle, appealing to those seeking authenticity and heritage. This historical significance, coupled with the current “winemaking Renaissance,” creates a dynamic environment where ancient traditions are being revitalized with modern techniques .

The strategic geographic location of Armenia, at the crossroads of Europe and Asia, offers potential access to multiple markets, although this advantage requires careful navigation of regional geopolitics. While not explicitly detailed in the provided snippets, Armenia’s relatively lower labor costs compared to many European countries can also be an attractive factor for investors looking to optimize production expenses.

The growing potential for wine tourism, driven by Armenia’s rich winemaking history and picturesque landscapes, presents another competitive advantage . The unique cultural experiences associated with wine production and tasting can attract tourists and further boost the industry’s growth. Additionally, the continued use of traditional methods like aging wine in “karases” adds a distinctive element to Armenian winemaking, appealing to niche markets interested in unique and artisanal products .

The combination of unique indigenous grape varieties and the distinctive volcanic terroir allows Armenian wines to develop a strong brand identity in the global market. The absence of phylloxera and the presence of old, own-rooted vines contribute to higher quality grapes and wines. The ongoing “winemaking Renaissance” signifies a renewed focus on quality and innovation, attracting expertise and investment. These factors collectively provide a compelling set of competitive advantages for investors in Armenia’s wine and beverage sector.

Success Stories: Case Studies of Thriving Businesses in Armenia’s Wine and Beverage Industry

Armenia’s wine and beverage industry is home to numerous thriving businesses that exemplify the sector’s potential and offer compelling case studies for prospective investors. These include both established players with long histories and newer, innovative ventures.

Voskevaz Winery, founded in 1932, represents a long-standing tradition in Armenian winemaking, notably continuing the ancient practice of aging wine in traditional clay vessels known as “karases” . Armenia Wine Company, established in 2006, has grown into a major producer, bottling 12 million bottles of wine, cognac, and brandy annually and even featuring a wine museum, highlighting the blend of tradition and modernity in the industry . Karas Wines is another significant player, recognized for its extensive vineyards spanning over 420 hectares, demonstrating the potential for large-scale wine production in Armenia .

The industry also boasts a vibrant scene of boutique wineries. Trinity Canyon Vineyards, founded in 2016, exemplifies this trend, producing 100,000 bottles annually and showcasing a focus on quality and innovation . Other notable wineries contributing to Armenia’s growing reputation include Areni Wine, Qotot Wines, Koor, Yacoubian-Hobbs, Keush, Sarduri, Voskeni, and Van Ardi Wines . ArmAs Winery in the Aragatsotn Province is another example of a successful wine producer leveraging Armenia’s unique terroir .

The presence of both large-scale producers and numerous smaller, boutique wineries indicates a diverse industry catering to various market segments and investment levels. The coexistence of long-established wineries alongside newer ventures demonstrates both the enduring tradition and the ongoing innovation within the Armenian wine sector. The success of established spirits brands like Stepanakert Brandy Factory complements the growth in the wine sector, suggesting opportunities across the broader beverage industry. These success stories provide tangible evidence of the viability and potential profitability of investing in Armenia’s wine and beverage industry.

Why Armenia Should Be Your Next Investment Destination in the Wine and Beverage Industry

Armenia presents a compelling and increasingly attractive destination for investments in its dynamic wine and beverage industry. The nation’s unparalleled historical heritage as the cradle of winemaking provides a unique and marketable foundation, appealing to a global audience that values authenticity and tradition. This rich history is coupled with a favorable climate and diverse terroir, ideally suited for cultivating a wide array of indigenous grape varieties that yield distinctive, high-quality wines.

The industry is currently experiencing a significant resurgence, marked by increasing production capacity, diversification into other beverages like whiskey, and a growing global recognition of Armenian wines. This growth is supported by a rising domestic and international demand, particularly in key markets like Russia and the United States, with expanding opportunities in Europe and beyond. The Armenian government has demonstrated a strong commitment to fostering this growth through a range of incentives, including tax benefits, financial support, and the establishment of Free Economic Zones. Strategic initiatives by the Vine and Wine Foundation of Armenia further bolster the industry’s global promotion and development.

Armenia’s competitive advantages, such as its unique grape varietals, the absence of phylloxera, and the presence of old, own-rooted vines, contribute to the production of exceptional wines with distinctive character. The growing wine tourism sector adds another layer of economic potential, capitalizing on the country’s rich history and picturesque landscapes. Success stories of thriving businesses within the industry provide concrete evidence of the opportunities available for both large-scale and boutique ventures.

Navigating the legal and economic policy framework reveals a government actively working to create a favorable investment climate, particularly for export-oriented businesses in the manufacturing and agricultural sectors. The prioritization of high-value-added industries like wine production in national development strategies signals a long-term commitment to the sector’s success.

In conclusion, the unique combination of historical significance, current growth momentum, proactive government support, and distinct competitive advantages positions Armenia as a prime investment destination in the wine and beverage industry. Potential investors, international business owners, and industry stakeholders are strongly encouraged to explore the compelling opportunities that this ancient land with a vibrant future has to offer.